Discover where to buy the top cryptocurrencies by exploring a detailed overview of those that are currently on the market.

Bitcoin (BTC) has been a ground-breaking digital currency since its launch in 2009. The ability to facilitate peer-to-peer transactions without the use of a middleman, like a bank, is one of its distinctive features, which has prompted a boom in the development of additional cryptocurrencies and digital assets that make use of blockchain technology.

A blockchain essentially acts as a digital public ledger, appending each transaction with a unique “hash” or identity to the end of the ledger.

Blockchain technology has gained attention thanks to the success of Bitcoin and opened doors for its potential to decentralise and improve the digital economy, defying established standards in the process.

Contents

Understanding Crypto Coins vs. Tokens

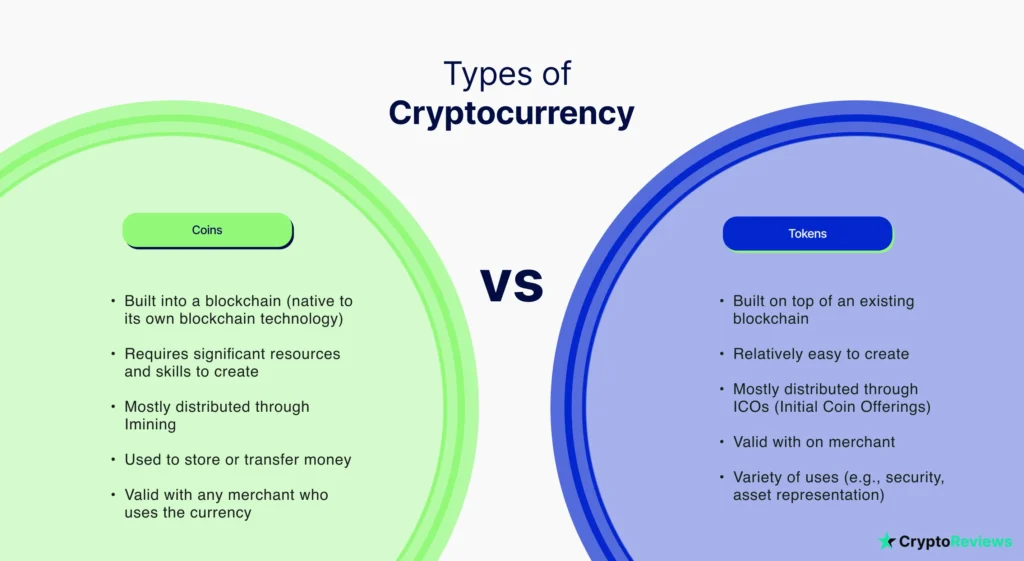

Before delving into the world of cryptocurrencies, it’s crucial to distinguish between a coin and a token. In cryptocurrency discussions, people often use these terms interchangeably, even though they have distinct meanings.

A digital coin operates on its own blockchain and functions similarly to conventional money. It serves as a store of value and a medium of exchange between two parties engaged in a transaction. Bitcoin and Litecoin (LTC) are examples of coins.

Tokens, however, have a broader range of applications beyond serving as digital money. Developers build these on existing blockchains and use them in software applications to do things like provide app access, verify identity, or track products in a supply chain.They can represent digital art (as seen with NFTs, or “non-fungible tokens” that authenticate something as unique).

There has also been exploration into using NFTs with tangible assets, such as physical art and real estate. Ether is an example of a token, which is used for transactions on the Ethereum (ETH) network.

Why is there a plethora of cryptocurrencies?

Blockchain technology is open source, which means any software developer can leverage the original source code to innovate and create something new. Developers have done exactly that. Estimates currently suggest that over 10,000 different cryptocurrencies circulate, and this number keeps growing. Just four years ago, the number of cryptocurrencies exceeded 1,000.

The ease of developing new cryptocurrencies contributes to the surge. You can use one’s source code to construct another. For example, you can use the Ethereum network to create your own digital coins.

Occasionally, there are “forks” in the software code that alter the governance rules of a cryptocurrency, leading to the creation of a new one. Bitcoin Cash (BCH) was established in 2017 as a result of a Bitcoin fork that allowed more transactions to be recorded on a single block of the blockchain.

The rising prices of cryptocurrencies

The rising prices of cryptocurrencies have enticed many developers to try and get a piece of the pie. Furthermore, blockchain technology has applications beyond just digital currencies. Therefore, while some cryptocurrencies may be a bubble waiting to burst, the decentralized nature of the technology and the wide range of its potential applications in the software industry are two reasons for the abundance of cryptocurrencies.

Key Categories of Cryptocurrency

Bitcoin, the pioneer of cryptocurrencies, has paved the way for a multitude of “altcoins” (a term derived from “alternative coin”). Identifying the best cryptocurrencies is a challenging task, but Bitcoin and some of the largest altcoins stand out due to their scalability, privacy, and the range of functionalities they offer.

Each cryptocurrency has unique features, designed according to the developer’s intent. Therefore, it’s hard to pinpoint a single “best” cryptocurrency. Here’s a snapshot of some of the most prominent digital coins and their uses.

| Coin | Total Market Value |

| Bitcoin | $567,479,946,096 |

| Ethereum | $223,175,662,203 |

| Tether | $83,814,627,450 |

| Binance Coin | $36,614,877,914 |

| USD Coin | $26,689,464,122 |

| XRP | $36,346,878,365 |

| Terra | $480,154,738 |

| Solana | $9,395,492,157 |

| Cardano | $10,680,543,992 |

| Avalanche | $4,580,676,824 |

Bitcoin

Utilizing blockchain technology, Bitcoin enables payments and digital transactions as the first decentralized cryptocurrency. Unlike traditional systems where a central bank controls the money supply (like the Federal Reserve in collaboration with the U.S. Department of the Treasury) or third parties validate transactions (such as your local bank, credit card issuer, and the merchant’s bank), Bitcoin’s blockchain serves as a public ledger of all Bitcoin transactions.

This ledger enables a user to demonstrate ownership of the Bitcoin they’re attempting to use and can help deter fraud and unauthorized manipulation of the currency.

A decentralized currency can expedite peer-to-peer money transfers (like those between parties in two different countries), making them faster and cheaper than traditional currency exchanges involving a third-party institution.

Ether (Ethereum)

Ether serves as the transactional token on the Ethereum network. Using blockchain technology, Ethereum facilitates the creation of smart contracts and other decentralized applications. This means you don’t have to distribute the software on app exchanges like Apple’s App Store or Google Play Store, where you might lose 30% of your revenue to tech giants.

Ethereum acts both as a cryptocurrency, denominated in units called Ether, and as a software development platform.

Tether

Tether is a stablecoin, or a currency linked to a fiat currency — in this case, the U.S. dollar. The concept behind Tether is to amalgamate the advantages of a cryptocurrency (such as eliminating the need for financial intermediaries) with the stability of a currency issued by a sovereign government (as opposed to the extreme price volatility associated with many cryptocurrencies).

Binance Coin

Binance Coin is accessible on the Binance cryptocurrency exchange platform, along with other digital coins available for trading, not only acts as a currency but also supports tokens that pay fees on the Binance exchange and power Binance’s DEX for app development.

USD Coin

USD Coin is another stablecoin, and, like Tether, it is tied to the U.S. dollar. Also similar to Tether, USD Coin is hosted on the Ethereum blockchain. The objective behind USD Coin was to create a “fully digital” dollar, one that possesses the stability of U.S. fiat currency but doesn’t necessitate a bank account or residency in a specific country. Rather than an investment, USD Coin is envisioned as everyday money that can be spent with online merchants.

Is there a variety in cryptocurrency trading methods?

Investing in cryptocurrencies differs from investing in company stocks. While stocks signify ownership in a business and entitlement to the profits it generates, buying cryptocurrency coins is essentially a speculative gamble on the price movement of that digital currency.

Supply and demand govern the high unpredictability of digital currency, which is not a dynamic asset by itself.

You can trade cryptocurrencies for other digital currencies or fiat currencies like the U.S. dollar using a digital wallet on a trading app.

But you don’t have to rely solely on trading to make a profit. You can “stake” certain cryptocurrencies to earn rewards. After purchasing a crypto, you can hold it in an account and use it to validate transactions on the blockchain network.

This approach to powering a blockchain network is termed “proof of stake,” and the crypto owner can earn a sort of dividend by staking their holdings, typically paid in additional coins or tokens.

Where to purchase a variety of cryptocurrencies

Given the multitude of cryptocurrencies currently available, there isn’t a single platform that provides access to all of them. However, Coinbase is one of the largest trading platforms and currently supports over 100 cryptocurrencies (including most of the top 10 largest cryptos by market cap). Binance is another leading trading platform where Binance Coin and tokens can be traded.

If you’re interested in purchasing both company stocks and cryptocurrency from a single platform, consider the following apps:

- Kraken

- Kucoin

- Gemini

- And others…

While these trading apps may not support all account types like a comprehensive stock broker, they offer a wide range of functionalities that merge basic crypto and stock trading with digital banking capabilities.

This is merely a glimpse into the vast world of cryptocurrency. Within the digital economy, people are using thousands of different digital currencies, all leveraging blockchain technology, for an incredibly diverse array of applications.

Bitcoin remains the most popular crypto due to its traction among a younger generation of consumers, but developers are constantly innovating new blockchain technologies and uses for them. These advancements add significant value to platforms like Ethereum, which are used to develop new software.

For investors looking to the future, this could be highly attractive as decentralized blockchain could eliminate third parties from business transactions and streamline global payments.