Blockchain, the foundational technology behind the pioneering cryptocurrency Bitcoin, emerged as a game-changer in the digital realm.

Consider it as the robust infrastructure supporting cryptocurrencies, where blockchain acts as the roads on which these digital currencies travel.

While experts may hold varying opinions on the future of cryptocurrencies, there is unanimous agreement on the immense potential of blockchain technology.

Within this comprehensive blockchain guide for beginners in 2023, our aim is to unravel the complexities of blockchain and present it in easily understandable terms.

Contents

- 1 Embracing the Era of Blockchain: Exploring its Tremendous Potential

- 1.1 What This Beginner’s Guide to Blockchain is Not

- 1.2 Demystifying Blockchain: An Easy-to-Understand Explanation

- 1.3 The Genesis of Blockchain: Bitcoin’s Pioneering Role

- 1.4 The Decentralized Nature of Blockchain

- 1.5 Are There Different Types of Blockchain?

- 1.6 Exploring the Technical Advantages of Blockchain

- 1.7 Practical Advantages of Blockchain: An Overview

- 2 How Blockchains Function

- 2.1 Introducing Miners

- 2.2 Where is the Blockchain Stored? Let’s Discuss Nodes

- 2.3 How Are New Blocks Created and Verified?

- 2.4 The Protocol Governs the Rules of the Blockchain

- 2.5 The Significance of Blockchain Decentralization

- 2.6 Maintaining Information: Distributed Ledger Technology

- 2.7 Banks and Centralized Ledgers

- 2.8 The Power of Miners

- 3 Applications in Cryptocurrencies

- 4 Advantages of Blockchain Technology

- 4.1 The Value of Blockchain Technology:

- 4.2 Blockchain Empowers Digital Freedom

- 4.3 Enhanced Security through Decentralization:

- 4.4 Streamlined Value Exchanges through Automation

- 4.5 Enhancing Anonymity through Blockchain and Cryptocurrencies:

- 4.6 Blockchain and Cryptocurrencies as Safeguards Against Financial Control

- 4.7 Leveraging Blockchain for Unique Digital Assets:

- 5 Is Blockchain Safe?

- 6 A Journey Through the History of Blockchain Technology

- 7 The Ever-Evolving Landscape of Technology:

Embracing the Era of Blockchain: Exploring its Tremendous Potential

Many acknowledge blockchain technology as a monumental advancement, perhaps the most significant since the internet’s inception.

Consequently, industry giants such as Google and Amazon are fervently pursuing their own blockchain solutions, eager to seize the opportunities it presents.

Investing your time in understanding the essentials of blockchain, as elucidated in this comprehensive guide, will yield tremendous rewards.

Consider this analogy: reading a book about the internet in 1994, a time when TV shows were still discussing the emergence of emails.

The future of decentralized technology looks bright, whether cryptocurrencies captivate you or the broader scope of blockchain technology fascinates you. Familiarizing yourself with the fundamentals of blockchain is essential.

This encompasses a simplified explanation of how blockchains operate, the problems they address, and the remarkable benefits they offer the world.

If your curiosity lies more with cryptocurrencies than the underlying technology, you may have overlooked our introductory guide to Bitcoin. Be sure to give it a read!

As decentralized technology continues to shape our future, equipping yourself with a foundational understanding of blockchain is a must.

What This Beginner’s Guide to Blockchain is Not

We aim to clarify that this beginner’s guide to blockchain doesn’t teach you how to develop blockchains or dive into the technical details.

If you aspire to become a blockchain professional or desire in-depth knowledge of the technical intricacies, we recommend exploring our partner Blockgeeks. By using our exclusive coupon codes CryptoManiaksPRO and CryptoManiaksACC, you can enjoy a 20% discount on their premium products.

Blockgeeks offers exceptional online resources tailored for these purposes and has already trained numerous blockchain professionals.

Within this blockchain 101 guide, we will focus on the transformative nature of blockchain technology and explore its various applications in the world around us.

Demystifying Blockchain: An Easy-to-Understand Explanation

Think of a blockchain as a chain made up of blocks, where each block contains digital information. Picture these blocks as neatly wrapped presents, holding packets of data.

In the context of Bitcoin’s blockchain:

- Each block consists of a series of Bitcoin transactions that occurred within a specific time period.

- Collectively, all the blocks form Bitcoin’s blockchain, serving as a ledger of all the transactions since its inception.

The Genesis of Blockchain: Bitcoin’s Pioneering Role

Bitcoin, the first practical application of blockchain technology, emerged in response to the inefficiencies of centralized banking systems.

Its launch in 2009, closely following the 2007/2008 financial crisis, was not coincidental.

In every example, you place trust in an intermediary with your personal information. Centralized data collection exposes you to security risks because a company owns your information and decides its usage.

The Decentralized Nature of Blockchain

Blockchain operates as a network of computers scattered across the globe.

These computers, collectively contributing to a particular blockchain, hold all the recorded data and transactions.

This decentralization ensures the resilience and robustness of blockchains, enabling them to withstand power outages and political disruptions.

The strength of a blockchain increases with the number of participating computers. This decentralized approach lies at the core of how blockchains function.

Are There Different Types of Blockchain?

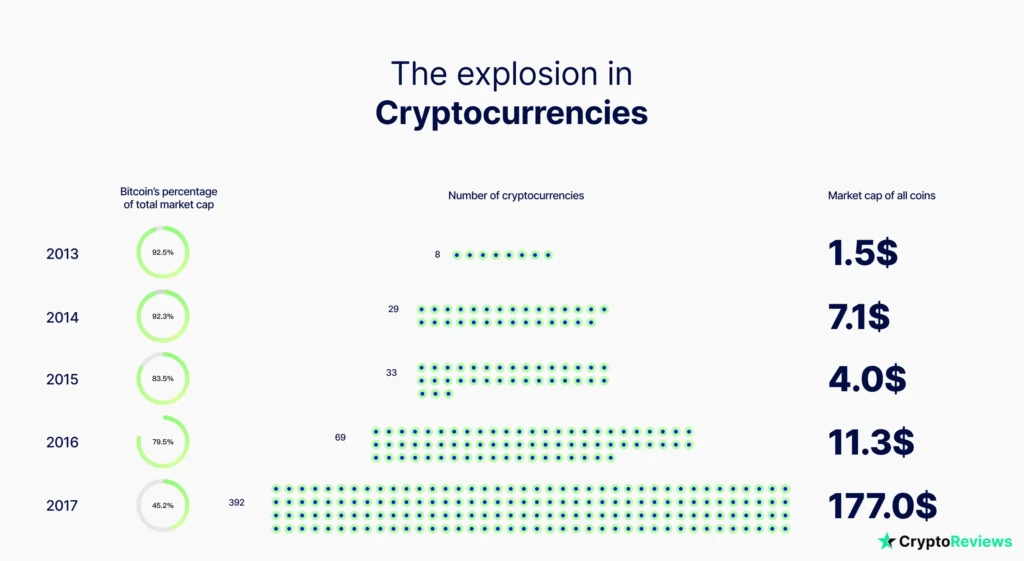

Currently, there exist a plethora of blockchains, with estimates surpassing 10,000 in number. These blockchains can generally be classified as either public or private.

Public Blockchains: These blockchains utilize open source software that is accessible to all participants in the network. Anyone can join the network, and it operates on a global scale. Many cryptocurrencies, such as ERC20 tokens on the Ethereum blockchain, are built on public blockchains.

Private Blockchains: Similar to public blockchains, private blockchains adhere to the same underlying principles but utilize proprietary software hosted on private servers. Companies like WalMart are developing their own private blockchains to track supply-chain logistics.

Exploring the Technical Advantages of Blockchain

Blockchain technology stands as one of the most promising and innovative technologies of our time. It offers a method of recording and transferring data that is transparent, trustworthy, and verifiable.

Blockchain enables individuals and companies to participate in a transfer system that is completely transparent, democratic, and secure.

Most importantly, it allows for trustless storage and transactions, eliminating the need for intermediaries. The significance of these benefits may not be immediately apparent, so here are some examples to illustrate their impact.

Visa monetizes trust by acting as the intermediary between merchants and customers. Amazon monetizes trust by acting as the intermediary between sellers and customers. Uber monetizes trust by acting as the intermediary between drivers and customers.

The list goes on, and in every example, trust is placed in an intermediary with one’s personal information.

Centralized data collection poses security risks, as your information is no longer under your control but is owned by a company, which can determine its usage at their discretion.

The adoption of blockchain technology eliminates the need for third parties and enables trustless peer-to-peer transactions.

In the worst-case scenario, it reduces costs for companies and fees for end-users in trust-based services.

In the best scenario, it completely eliminates the necessity for intermediaries in numerous industries.

Practical Advantages of Blockchain: An Overview

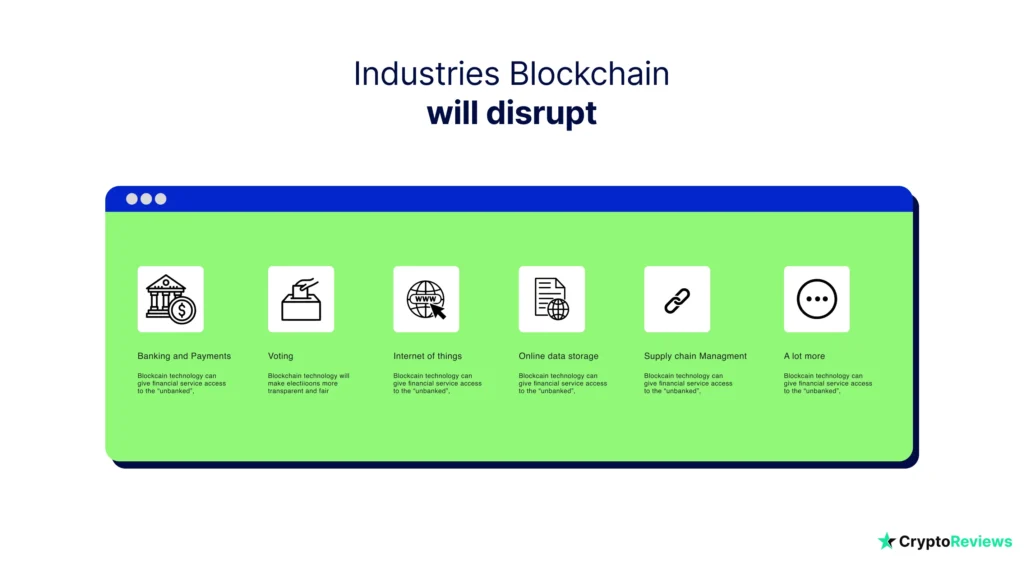

Blockchain technology is causing significant disruptions in various industries, including:

- Banking and Payments: It has the potential to provide financial services to the unbanked population worldwide while enhancing transparency within the monetary system for those already banked. Many banks are actively developing their own blockchain solutions to improve speed, security, and efficiency.

- Online Data Storage: Traditional cloud storage systems rely on large centralized databases, exposing data to privacy breaches and environmental risks. Blockchain offers a safer alternative by eliminating single points of failure and enabling cost-effective storage solutions.

- Voting: Blockchain has the power to revolutionize elections, making them more transparent and fair than ever before in human history.

Blockchain technology is disrupting or has the potential to disrupt any industry involving data and transactions, including sectors with trust-based intermediaries like financial companies and governments.

In our beginner’s guide to blockchain, we will delve into each aspect in more detail, exploring the specific benefits, problem-solving capabilities, and advanced concepts.

If the technical details of blockchain and its ties to cryptocurrencies don’t interest you, skip ahead and explore chapters that highlight the benefits of Blockchain Technology.

How Blockchains Function

Introducing Miners

The term “miner” can have various meanings based on specific blockchains’ criteria.

For simplicity, we’ll use “miner” to describe individuals or companies running specialized software to contribute to the growth of the Bitcoin blockchain.

Miners play a crucial role in blockchain functionality. Without them, the network wouldn’t have computers to process transactions.

In public, open-source blockchains like Bitcoin, the system rewards the computer that successfully discovers the next block. Typically, these rewards come in the form of cryptocurrencies.

Where is the Blockchain Stored? Let’s Discuss Nodes

Nodes are computers hosting a copy of the blockchain.

Unlike miners, nodes’ primary role isn’t finding the next block in the sequence. They validate transactions and establish communication with other nodes and miners.

Nodes act as relay towers, ensuring the accuracy and updating of the underlying blockchain.

How Are New Blocks Created and Verified?

Each block in a blockchain contains a set of data, such as transactions in the case of Bitcoin. This data is organized into a single digital folder, known as a block.

A miner confirms the validity of this block and adds it to the existing chain by connecting it to the previous block.

The Bitcoin blockchain adds new blocks, which consist of transactions, approximately every few minutes through “mining”. This process establishes a link between the new blocks and the already existing chain of blocks.

However, before being added to the existing chain, new blocks undergo a validation process.

Nodes play a crucial role in this validation process. In the context of Bitcoin, nodes are responsible for verifying the transactions that occur across the Bitcoin network.

Here’s how it works: Miners select which transactions to include in a new block. Nodes then verify all the transactions within that block. Finally, if everything checks out, nodes propagate the new block to other nodes in the network.

The Protocol Governs the Rules of the Blockchain

Each blockchain operates based on a protocol, also known as a “consensus algorithm.” A protocol is an agreed-upon set of rules that govern the interaction between computers participating in the network.

For instance, Bitcoin adheres to specific rules to ensure protocol standardization across all machines:

- A new block is added to the blockchain approximately every 10 minutes, although this timeframe can vary for different blockchains.

- The reward given to miners for their efforts reduces after every 210,000 blocks. This feature ensures that Bitcoin has a finite supply, capped at 21 million.

- Miners must solve a complex mathematical problem to find the next block. The protocol adjusts the difficulty level of this problem based on the number of miners competing, ensuring a fair and balanced network.

The Significance of Blockchain Decentralization

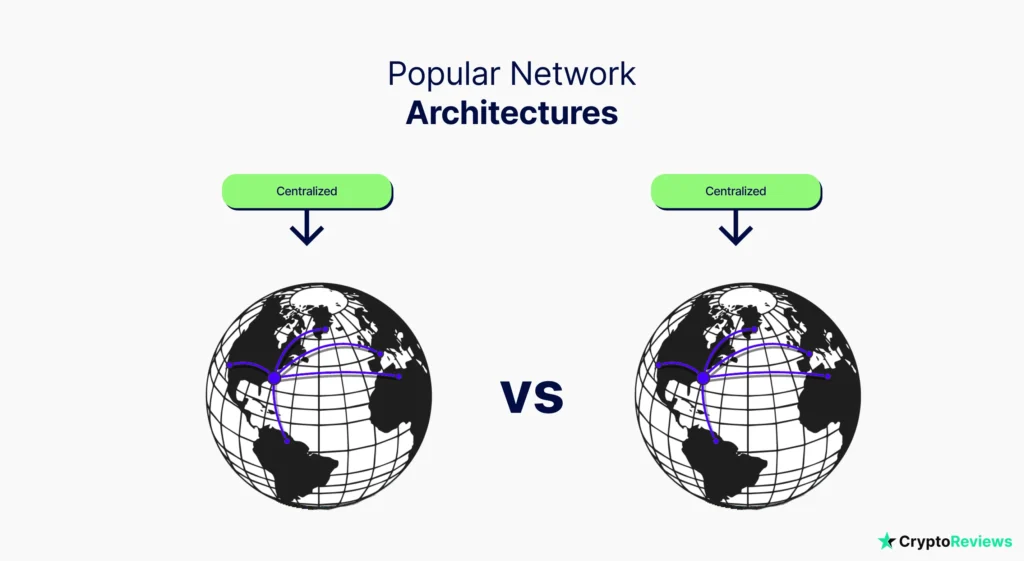

Blockchain technology operates in a decentralized manner, with individual computers connected to each other through the internet across the globe.

Each computer participating in a blockchain network runs the same software. Even if one computer becomes disconnected, the network remains operational.

Even in the unlikely event that all computers worldwide simultaneously shut down, the blockchain continues to store its data in distributed ledgers.

If a global power outage occurs, computers will retain a copy of the ledger from the last update. Cryptocurrencies like BTC wouldn’t disappear even if ledger updates paused due to power outages.

This characteristic makes blockchain technology highly resilient, capable of withstanding power outages and political instability.

Blockchain is a trustless system of digital exchange, spread across multiple machines that all execute the same program.

By distributing ledgers across every computer participating in the protocol, blockchains eliminate the need for intermediaries, centralized authorities, and third parties.

Without the involvement of third parties, users can directly engage with one another without relying on centralized corporations or governments for trust or transaction facilitation.

This represents a form of peer-to-peer (P2P) collaboration.

While the concept of P2P collaboration is not new or radical, blockchain introduces the unique capability to store digital information, including transactions, in a distributed ledger that ensures immutability.

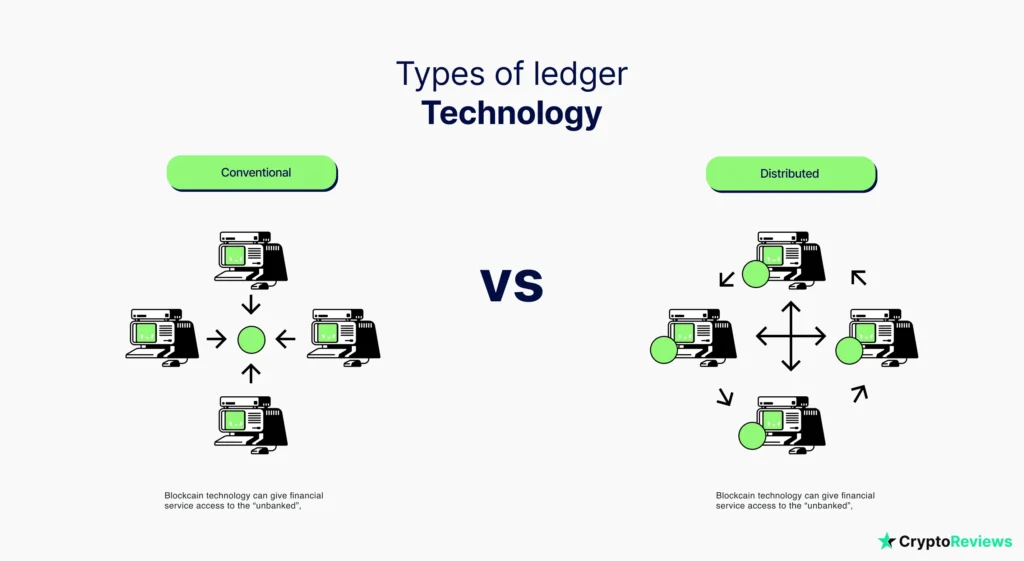

Maintaining Information: Distributed Ledger Technology

Participants in a blockchain distribute copies of all blocks among themselves to maintain the continuity of transaction history.

These participants are referred to as nodes. While miners play a role in building the blockchain by mining blocks, any individual or entity can act as a node.

Nodes run the software of the blockchain and regularly update themselves with the latest information from the blockchain.

There are various types of nodes:

- Lightweight Nodes: This version only retains information from a few weeks or even just a few hours back. It runs faster on machines but may be less accurate or secure since it relies on others to provide any missing data;

- Full Nodes: These computers maintain a complete copy of the blockchain, encompassing information from the very first block, known as the genesis block.

Hosting a node contributes to the upkeep and accuracy of the blockchain.

Nodes and miners work in tandem, cross-referencing each other’s actions to build and maintain the blockchain.

When information is stored on multiple machines in this manner, it is known as Distributed Ledger Technology (DLT). Blockchain stands as one of the most well-known examples of this technology.

Banks and Centralized Ledgers

A prime example of a centralized ledger can be found within traditional banks. These institutions maintain a centralized ledger to record all deposits and withdrawals. Customers pay for this service, which involves significant investments in physical infrastructure and round-the-clock professionals to ensure its operation.

Contrasting with traditional banks, blockchain operates in a decentralized manner. Instead of relying on a single institution, the blockchain is hosted by participants across the network. This eliminates the need for costly centralized headquarters and minimizes potential vulnerabilities. Consequently, blockchain is a more cost-effective and resilient alternative.

The Power of Miners

In earlier sections of this blockchain guide, we briefly mentioned the role of miners. Now, let’s delve deeper into their significance.

Miners employ computational power and consume electricity to validate the next block in the Bitcoin blockchain. This process, known as Proof-of-Work, incurs real-world costs. It is this expenditure that contributes to the robustness of the Bitcoin protocol. Each block within the blockchain is unique, akin to a tangible digital asset.

The strength of a blockchain is directly correlated with the number of miners participating in the network. Comparing Bitcoin, which boasts the largest miner network among cryptocurrencies, to a nascent blockchain reveals a disparity. A new protocol with fewer miners tends to be more centralized, making it susceptible to weaknesses and resource shortages for building and safeguarding information.

As a blockchain grows longer over time, its strength increases. Bitcoin’s blockchain has reached such a substantial size that attempting to recreate it would require computational power exceeding current capabilities. This high level of trustworthiness in transactions and the extraordinary strength of the protocol exemplify the power of Bitcoin’s blockchain.

Applications in Cryptocurrencies

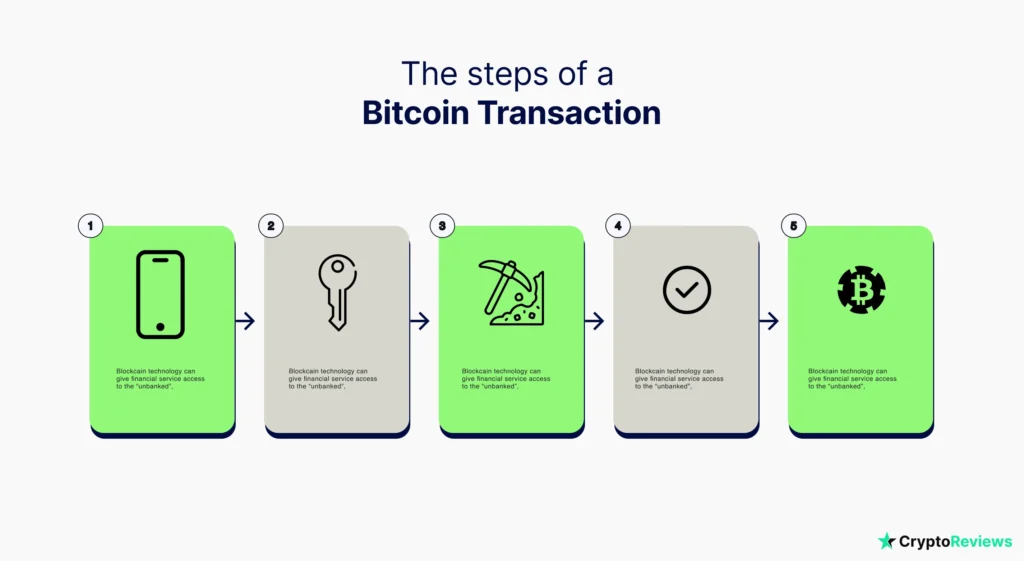

A Practical Example of the Bitcoin Network in Action

To provide a basic understanding of how a Bitcoin transaction operates, let’s explore a simplified scenario. This example will introduce you to the fundamentals and serve as a starting point for your exploration into the fascinating realm of cryptocurrencies.

- Seth intends to send 0.01 Bitcoin from his wallet to Charlotte`s wallet.

- Initiating the transaction, Seth accesses his wallet application and inputs Charlotte`s public address into the designated “send address” field.

- To ensure the transaction’s accuracy and security, Seth employs his private key, validating the specified amount and initiating the transfer by sending the transaction to the Bitcoin blockchain.

- In this scenario, Doug, a diligent miner, processes the transaction and includes it in the upcoming block of the blockchain. Doug levies a transaction fee of 0.000056 BTC, serving as an incentive that motivates miners to prioritize the transaction and incorporate it into the blockchain. Seth`s wallet automatically incorporates the fee into the total transaction amount.

- Nodes, essential participants within the Bitcoin network, verify the transaction’s validity and independently integrate it into their own copies of the blockchain.

- Within a matter of minutes, Charlotte`s wallet receives the transaction, promptly completing the fund transfer.

The Bitcoin system time-stamps all transactions and organizes them into blocks. These blocks join the blockchain roughly every 10 minutes.

Proof of Work: A Cornerstone of Bitcoin’s Value

Consensus algorithms have replaced the need for reliance on trusted intermediaries in peer-to-peer networks.

Instead of placing our trust in banks or centralized escrow services, we can now trust a decentralized system of individual nodes that collectively reach an agreement.

Bitcoin introduced the famous consensus algorithm known as Proof of Work (PoW). In PoW, miners utilize specialized hardware, called mining rigs, to continuously search for the next block in the Bitcoin blockchain.

In essence, mining is akin to solving a challenging mathematical problem through trial and error.

The more attempts a miner can make per second, the greater their chances of being the first to find the correct solution.

The individual or group that successfully discovers the next block is rewarded with a block reward.

This process forms the basis of how blockchain transactions are validated in PoW systems. Miners and nodes collaborate to verify newly proposed blocks. Individuals invest significant amounts, ranging from hundreds to millions of dollars, in mining equipment such as GPUs, fans, and substantial amounts of electricity.

PoW is what sets Bitcoin apart as the most robust and trustworthy cryptocurrency in existence.

As more miners compete to add blocks to the blockchain, the difficulty of solving the cryptographic puzzle increases. This necessitates greater CPU power and electricity consumption, both of which entail real-world costs.

It is this foundational infrastructure that ensures the security and stability of Bitcoin, distinguishing it from other cryptocurrencies.

How Bitcoin Wallets and Addresses Function

In the Bitcoin network, users have the ability to transfer BTC to anyone across the globe.

To facilitate these transactions, participants utilize software called a wallet. Generating addresses within a wallet is a straightforward process that requires no personal information.

Once created, each wallet produces a public address and a private key, each serving a distinct purpose. Understanding how these components operate is crucial for navigating the world of cryptocurrencies.

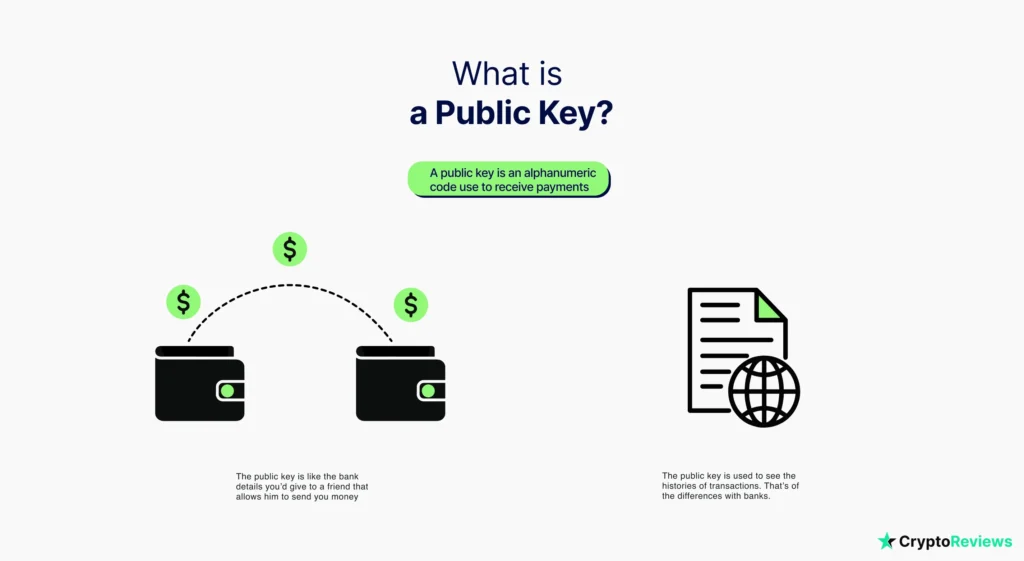

Understanding Public Keys

A public address is an alphanumeric code that serves as a unique identifier, linking transactions to the sender and recipient.

The public address is used for two main purposes:

- Receiving payments: Similar to sharing your bank details with a friend to receive money, providing your Bitcoin wallet’s public key enables others to send you Bitcoin. Simply create a Bitcoin wallet and share your public key with those who wish to send you funds.

- Accessing transaction history associated with the public address: One of the defining features of Bitcoin is its pseudonymous nature. The transaction history linked to a public address is publicly available to anyone through the use of the public key. However, the private key, which grants access to the funds, remains anonymous and unknown to others.

By utilizing public keys and addresses, Bitcoin enables secure and transparent transactions while preserving the privacy of individual ownership.

Recognizing the Value of Private Keys

Understanding the importance and differentiation of a private key is essential.

Although a private key is similarly an alphanumeric code, it serves a very distinct function. It enables access to the money stored in a particular wallet.

An individual can carry out operations from their wallet, such as transmitting Bitcoin to another wallet, by using a private key.

You need the private key to access money in a public wallet address. Because the system generates the private key only once, it’s vital to protect it. There is no way to recover a lost private key through any program, thus losing it means giving up access to the money.

It is imperative that you never divulge your private key to anyone. Maintaining the secrecy of your private key assures the safety and reliability of your wallet and money.

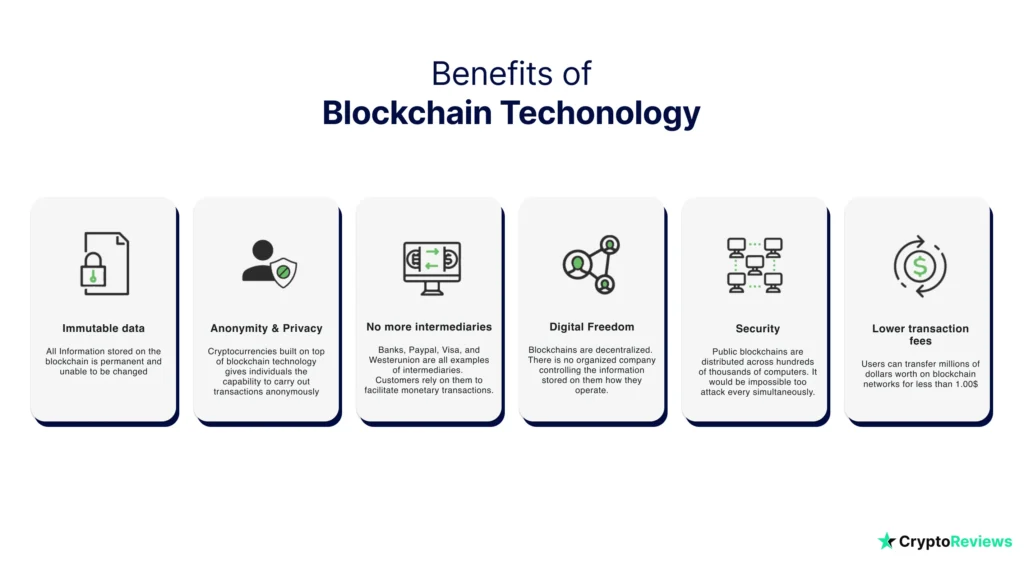

Advantages of Blockchain Technology

The Value of Blockchain Technology:

The main benefit of blockchain technology is its capacity for securely storing, validating, distributing, and permanently preserving huge amounts of data, including transaction records, without the aid of a reliable third party.

Blockchain has the potential to lead a deep technological transformation by automating the flow of information across various digital platforms.

The ability of blockchain to maintain immutable data is one of its fundamental advantages. In contrast to conventional storage techniques that rely on intermediaries, information kept on the blockchain is permanent and impenetrable.

Human interaction often introduces corruption, inefficiency, and unnecessary complexity to trustworthy transactions. Blockchain technology can automate these processes, potentially bringing significant changes to the economy and society.

The best illustration of how blockchain can serve as the structural framework for a new financial system is provided by Bitcoin.

The immutability provided by blockchain technology also goes beyond uses in the financial sector. You can host videos and broadcast content using it, ensuring the security and reliability of unique digital assets. This gives creators better options to monetize their work.

Blockchains’ decentralized nature, in which they are not under the authority of a single body, is one of their distinguishing features. In contrast, by holding a massive amount of data on their own servers, internet behemoths like Google, Facebook, Amazon, and Microsoft significantly influence the online environment.

Many businesses offer free services, but it’s essential to realize that often, consumers become the product when their personal data is collected and sold to the highest bidder for profit.

Centralization, or the concentration of power in a small number of prominent online businesses, can result in problems including corruption and fewer incentives for technological innovation. An alternative paradigm that encourages transparency, security, and user empowerment is presented by blockchain technology.

Blockchain Empowers Digital Freedom

Unlike the centralized nature of our current technology landscape, public blockchains and their associated cryptocurrencies operate in a decentralized manner. They are not controlled or governed by any single entity or organization.

This decentralized characteristic of blockchain technology has the potential to disrupt and challenge existing monopolies in the tech industry.

In today’s world, we are accustomed to sharing digital information and conducting financial transactions over the internet. Blockchain technology takes this experience to a new level by offering numerous possibilities for people to interact and transact without relying on intermediaries or third-party companies.

By enabling decentralized peer-to-peer interactions, blockchain technology promotes freedom and individual entrepreneurship in the digital realm. It empowers individuals to have more control over their data, transactions, and online activities, fostering a new era of digital independence.

Enhanced Security through Decentralization:

One of the key advantages of blockchains is their ability to provide a high level of security by eliminating single points of failure.

In the current technology landscape, companies frequently fall victim to hacking attacks, resulting in the theft of sensitive personal information. Instances of compromised email addresses and credit card data being sold or stolen have become increasingly common.

Industries have emerged around collecting valuable information and notifying individuals of data breaches. You can even check if your data has been compromised in a data breach.

Inherent to their design, centralized systems have vulnerabilities as hackers can easily identify where the data resides. In contrast, decentralized systems, such as blockchain, lack such weak points.

Large public blockchains are distributed across numerous computers, making it virtually impossible for malicious actors to simultaneously attack every single node. This decentralized structure makes blockchain highly resilient and secure.

For instance, imagine you are purchasing a pair of unique, handcrafted shoes online. The shoemaker, operating a small business, hosts their website on a server and uses a simple plugin for credit card transactions.

Sadly, without your or the shoemaker’s knowledge, hackers compromise the server hosting the website, leading to malware collecting your private data without authorization.

Alternatively, if the shoemaker had chosen to display their Bitcoin public address on their website, you could have securely ordered the shoes and made payment in Bitcoin. In this scenario, the shoemaker’s private key would not have been compromised.

In comparison, when using traditional banking services, you place significant trust in the bank to handle your money securely and deliver promised services.

However, the reality often falls short of these expectations. Customers frequently encounter delays in payments, withdrawals, and money transfers. Accounts can be unexpectedly frozen or limited without clear explanations.

By leveraging blockchain technology, individuals can embrace a more secure and transparent financial ecosystem, free from the limitations and uncertainties associated with centralized systems.

Streamlined Value Exchanges through Automation

Blockchain technology revolutionizes value exchanges by automating transactions, eliminating the need to rely on centralized entities. Instead, users place their trust in computer programs that follow predetermined rules.

This automated process significantly reduces transaction fees to a negligible extent. For instance, blockchain networks enable users to transfer millions of dollars’ worth of value for less than $1.00.

As competition intensifies within the blockchain space, new options that offer even lower costs and faster transaction speeds will continue to emerge.

The era of paying substantial fees to credit card companies and relying on intermediaries like PayPal for online purchases is gradually coming to an end.

Cost Reduction for Merchants and Consumers:

Miners, responsible for building the blockchain network and validating transactions, charge a fee for their services. However, since they compete with one another to solve cryptographic puzzles and earn the opportunity to create the next block, costs remain proportionately low.

Moreover, the automation of transactions reduces the need for extensive corporate bureaucracy. By eliminating the requirement to pay thousands of employees, transaction fees can be reduced to remarkably low levels.

Consider the example of an online store selling wool hats at $20 each. With traditional payment processors like PayPal charging approximately 4% commission for validating transactions of this magnitude, if you sell 100 hats, you would essentially be giving away 4 hats in fees.

The impact on merchants worldwide becomes evident when considering the billions of dollars companies like PayPal are costing them. Now, imagine being able to reduce your monetary transaction fee to just $0.01 or even a fraction of a cent.

Blockchain technology turns this vision into a reality, empowering merchants with significantly reduced transaction fees and enabling a more cost-effective and efficient financial ecosystem.

Enhancing Anonymity through Blockchain and Cryptocurrencies:

Blockchain technology, coupled with cryptocurrencies, empowers individuals to conduct transactions anonymously and reclaim control over their financial privacy.

In an increasingly digital world, governments and large corporations are gaining unprecedented control over personal data. This encompasses not only innocuous information such as educational background and personal preferences but also extends to spending habits and financial transactions.

The accumulation of such data provides malicious actors with the means to manipulate and control one’s life. Blockchain-based solutions are emerging to address these concerns.

For instance, cryptocurrencies like Monero offer untraceable value exchanges, ensuring the privacy and anonymity of transactions. Projects like Skycoin aim to establish anonymous protocols that can rival the existing internet infrastructure, providing individuals with increased freedom and protection of their personal information.

Blockchain and Cryptocurrencies as Safeguards Against Financial Control

Traditional banks and governments have a history of impeding individuals from freely utilizing their own funds. A notable example is the Wikileaks case, where individuals attempting to donate through conventional banking channels had their accounts frozen. However, Bitcoin offered an alternative avenue, enabling seamless contributions to Wikileaks.

The freedom afforded by blockchain technology extends beyond monetary transactions. Authoritarian regimes that seek to censor internet searches can manipulate information flow with a mere switch. Decentralized exchange systems, such as blockchain, serve as a countermeasure, preventing such entities from controlling the dissemination of information.

Closer to home, consider the authority wielded over your bank account. At present, the government possesses the capability to freeze and liquidate assets. The question arises: can it truly be considered your money if such a level of control can be exerted over it? Such centralized control over personal wealth leaves society vulnerable to exploitation.

In countries plagued by governmental corruption or mafia-like influences, blockchain-based monetary systems are gaining increasing value, providing individuals with greater financial security and autonomy. The trend of empowering individuals and challenging financial control through blockchain solutions is set to continue.

Leveraging Blockchain for Unique Digital Assets:

The ease of reproduction has made it difficult to create uniqueness and successfully commodify digital material, such as music files represented by MP3s. Blockchain technology, on the other hand, has completely altered this market by enabling the creation of digital assets that are essentially one-of-a-kind and impervious to copying.

This innovation is mostly credited to blockchain’s decentralized and distributed ledger structure. Think of Bitcoin as an illustration of this. Rebuilding the entire blockchain would be necessary in order to attempt to produce a replica of a Bitcoin, which is both unfeasible and time- and resource-consuming. Blockchain’s core feature enables the development of digital assets with unmatched exclusivity and scarcity.

Is Blockchain Safe?

Addressing Concerns about Blockchain Security:

Cryptocurrencies and blockchain technology are occasionally adopted with trepidation, mostly because of worries about safety and security. Consumers are cautious to use a method that is still relatively new and unproven because they have come to trust traditional banking as being dependable and secure.

In contrast to conventional banking systems, blockchain technology actually delivers a superior level of security.

The transparency of blockchain is one of its main benefits. As public blockchains are open-source, anyone may check the underlying code’s functionality and scrutinize it. In addition, a sizable community is working hard to find and fix any potential vulnerabilities. Closed-source systems, such as banks, on the other hand, demand faith in the organization in order to set and enforce security measures.

Three levels of security are built into the blockchain, enhancing user protection:

Decentralization: Blockchain functions on a decentralized network, removing any single point of failure, in contrast to the centralized servers utilized by banks. As a result, data kept on the blockchain and digital transactions are intrinsically more secure.

Blockchain encrypts data using cutting-edge cryptographic methods, rendering it unavailable to unauthorized users. Even large organizations like the NSA have difficulty breaking some encryption systems now because of how strong it has become. Contrarily, the IRS and other governmental agencies might check traditional fiat currency transactions.

Public blockchains rely on miners and nodes to validate transactions and uphold the network’s security. There is no need to put your trust in one single entity thanks to this decentralized verification mechanism. Additionally, it guarantees that the network will continue to function despite political or environmental setbacks.

Blockchain technology provides a strong and dependable foundation that allays worries about the security and privacy of digital transactions and data by including these security features.

Trust: Centralized vs Decentralized

Decentralization is essential to blockchain technology’s level of security.

You are putting your trust in the technology itself by using a blockchain rather than a centralized organization like a bank. A blockchain’s automatic transaction processing eliminates the need for human intervention in the protocol.

Due to its decentralized nature, this system cannot be controlled by a single authority or have serious errors made by it. System operations are independent of the program as long as it is active.

Cryptography: Enhancing Security

Cryptography, specifically digital signatures, contributes to the second level of security in blockchain technology.

Each transaction is signed by the sender using their private key. The receiver then verifies the transaction’s authenticity using the sender’s public key.

However, it is essential to handle private keys with utmost care, treating them as valuable assets. Keeping them secret and secure is the responsibility of the user.

Miners/Nodes: Safeguarding the Blockchain

The third and final level of blockchain security involves miners and/or nodes.

These miners or nodes actively participate in the blockchain by continuously verifying all transactions taking place.

The distributed nature of miners/nodes ensures the integrity of the blockchain’s data. Attempts to rewrite or corrupt the blockchain are highly challenging because miners/nodes constantly maintain the accuracy of the data.

To compromise the integrity of a blockchain, an attacker would need to gain control of the majority of the miners/nodes, which is known as a 51% attack.

Larger protocols like Bitcoin are safe from this type of attack due to their size and widespread participation. However, smaller cryptocurrencies that build their own blockchains may face such risks, and it is important for early investors to conduct thorough research.

Should You Trust Blockchains?

Trust in blockchains is justified due to the three highly effective levels of security: decentralization, cryptography, and the involvement of miners and nodes.

Contrary to what some may claim, blockchain technology is constantly advancing and is already much safer than commonly portrayed by the media. In fact, you can confidently engage in activities like online gambling at reputable crypto casinos without concerns of being deceived.

Those who attempt to undermine blockchain based on security concerns are mistaken. Decentralized blockchain technology offers superior security compared to traditional methods of data storage. The core advantage consistently revolves around having financial autonomy and control over assets.

Blockchain empowers you with that authority.

With over 10,000 cryptocurrencies utilizing various forms of blockchain technology, the landscape continues to evolve rapidly. It is crucial to conduct thorough analysis and understanding of each cryptocurrency, as they differ significantly from one another.

In summary, blockchains deserve our trust because of their strong security features and their potential to bring transformative changes.

A Journey Through the History of Blockchain Technology

Significant milestones mark the history of blockchain technology, shaping it into the robust and secure systems we use today. From its early beginnings in the 1990s to the emergence of Bitcoin and the subsequent rise of blockchain-based platforms.

The Foundation:

Early Concepts and Merkle Trees In 1991, Stuart Haber and W. Scott Stornetta laid the groundwork for blockchain-like concepts with their research on a secured chain of blocks. In 1992, the introduction of Merkle Trees boosted blockchain efficiency by enabling the storage of multiple documents in a single block.

Decentralized Trust:

A Conceptual Breakthrough In 2002, David Mazieres and Dennis Shasha conceived the idea of decentralized trust within a network file system. This breakthrough marked a significant step forward in the development of decentralized systems.

Bitgold: A Flawed Yet Influential Proposal

In 2005, Nick Szabo proposed Bitgold, a protocol for decentralized property titles featuring a blockchain-like system. Despite its critical flaw known as the “double-spending problem,” Bitgold incorporated elements of Proof-of-Work and timestamping, laying the groundwork for future advancements.

The Emergence of Bitcoin and the Birth of Blockchain

In 2008, Satoshi Nakamoto published the groundbreaking whitepaper titled “Bitcoin – A Peer-to-Peer Electronic Cash System.” This document provided a solution to the double-spending problem and served as the foundation for the first functional blockchain. In 2009 along with Hal Finney and others, implemented the true blockchain technology, mining the initial blocks and Finney becoming the first recipient of a Bitcoin transaction.

The Rise of Blockchains in the Mainstream

Starting in 2014, blockchain technology gained significant attention and recognition. Bitcoin’s use and acceptance grew rapidly, establishing it as a legitimate payment method. Advancements in file sizes, transformative innovations, and cryptocurrency price surges further propelled the mainstream adoption of blockchains.

The Evolution of Blockchains Beyond Bitcoin

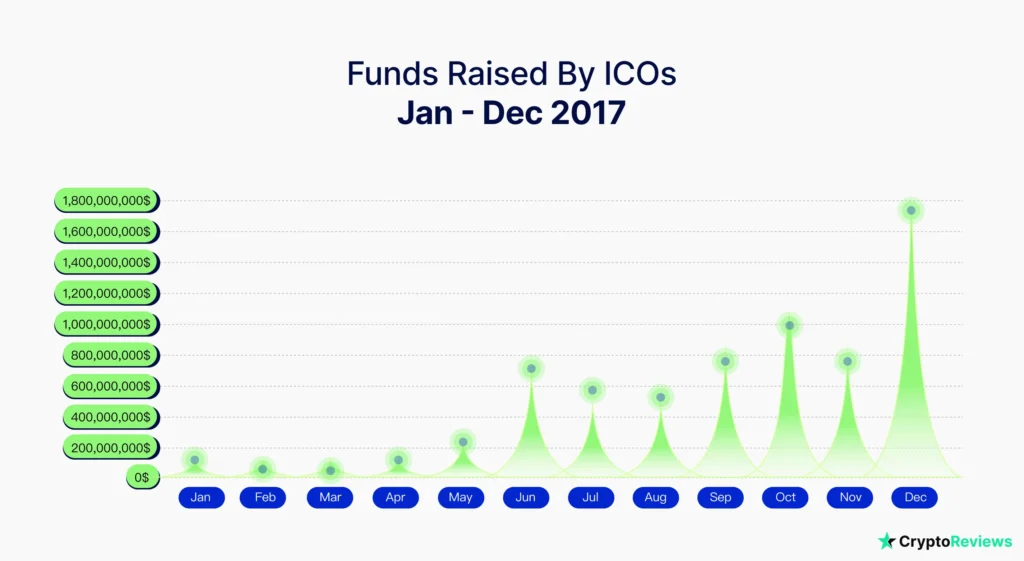

In 2014, The Economist introduced the concept of “Blockchain 2.0,” emphasizing the execution of applications on a blockchain. This paved the way for the rise of Decentralized Apps (DApps) and made Smart Contracts a powerful tool. Ethereum, launched in 2015 by Vitalik Buterin, expanded the possibilities by enabling DApps while offering similar functionalities to Bitcoin. The subsequent surge in blockchain-based projects and Initial Coin Offerings (ICOs) further demonstrated the growth and potential of blockchain-based platforms.

The history of blockchain technology is a testament to its continuous evolution and groundbreaking innovations. From its early conceptualization to the rise of Bitcoin and the expansion beyond, blockchains have revolutionized various industries, enabling decentralized applications and creating new funding models. As blockchain technology continues to advance, its potential for disruption and transformative change remains immense.

The Ever-Evolving Landscape of Technology:

The use of blockchain technology is expanding across a range of industries, from startups to global corporations like Google and Amazon. The meaning of “blockchain” is still changing, and many protocols offer diverse functionalities, thus the future is bright.

This guide’s content offers a strong basis for comprehending this technology. You will learn about the minute variations that make each cryptocurrency unique as you delve more into the world of cryptocurrencies.

We truly hope that this blockchain guide was helpful to you and that you now have a thorough understanding of blockchain technology.

Share this resource with your friends and anyone else you think would benefit from getting involved in this exciting field if you liked our presentation and want to help blockchain become widely used.