In this article, we want to share with you the best methods to purchase Bitcoin in 2023, and inform the advantages and disadvantages of each approach, provide guidance on how to choose the right one for you, and offer additional insights.

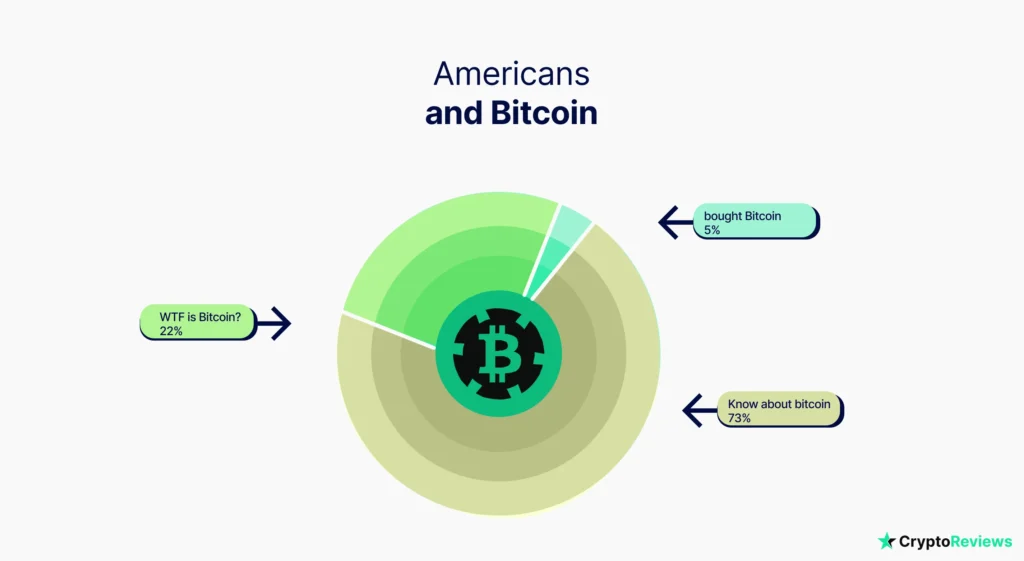

According to a recent survey, it was discovered that approximately 60% of Americans have heard of Bitcoin at least once. Surprisingly, only 5% of them actually hold any digital currency, which raises an important question: Are many people unaware of the best platforms for buying Bitcoin?

This inquiry, conducted by the Global Blockchain Council and SurveyMonkey, revealed that a majority of individuals find it challenging to acquire Bitcoin, however, reading this information, you will gain valuable insights into the best method of purchasing Bitcoin and receive clear guidance on various options tailored to your preferences.

Contents

- 1 Recommended Exchanges for Buying Bitcoin

- 2 Introduction To The Crypto World

- 3 Selecting the Ideal Platform for Your Requirements

- 4 Payment Methods Compared

- 5 The Most Economical Platform for Purchasing Bitcoin

- 6 The Optimal Method for Secure Bitcoin Purchases

- 7 The Simplified Method for Purchasing Bitcoin

- 8 The Expedited Approach to Buying Bitcoin

- 9 Locating Nearby Bitcoin Purchase Opportunities

- 10 Optimal Methods for Anonymous Bitcoin Purchases

- 11 Top Choices for Buying Bitcoin with PayPal

- 12 Preferred Platform for Buying Bitcoin with Credit/Debit Card

- 13 Recommended Platforms for Buying Bitcoin with a Bank Account

- 14 Purchasing Other Cryptocurrencies (Altcoins)

- 15 FAQS

Recommended Exchanges for Buying Bitcoin

With our expertise in the world of cryptocurrencies. We have encountered numerous challenges related to liquidity, security, and customer service. Through our own mistakes, we have acquired valuable knowledge. Consequently, we have compiled a list of trusted exchanges that we personally use and consider the best platforms for buying Bitcoin. Our top choices are eToro, Coinbase, and BitBuy.

eToro

A prominent platform for cryptocurrency trading and investing, has garnered recognition due to its distinct logo featuring the name in green with bull-like horns. With a user base exceeding 20 million, stands as one of the premier choices for purchasing Bitcoin.

Pros:

- NFTs act as digital proof of ownership, existing on the blockchain network

- The creation of an NFT, known as minting, involves its publication on the blockchain, facilitating its purchase or sale

- While 2021 witnessed a significant expansion in the NFT market, it experienced a contraction in the following year.

Cons:

- Since the majority of NFTs represent static assets that don’t produce any standalone income, their worth is mainly dictated by subjective elements like the demand from buyers.As a result, the current high prices may not be sustainable, and NFTs could experience a significant drop in value

- The creation and sale of NFTs are not free, and the associated fees can exceed the value attributed to an NFT by other users on a marketplace

- NFTs and the underlying blockchain technology have an environmental footprint, as they consume a substantial amount of energy to create and validate transactions

- Some NFT projects may not provide the rights to the digital asset itself, so it’s important to do your due diligence to determine the location of the digital asset (at a web address, in centralized cloud storage, etc.) and whether you have the ability to move the asset to a different location

Coinbase

Established in 2012, the platform is widely regarded as one of the best for buying Bitcoin, attracting a large number of investors. With over 68 million users, they became a publicly traded company in April 2021, and operates in over 100 countries and supports a diverse range of 100+ cryptocurrencies, with ongoing additions to its offerings.

Pros:

- NFTs act as digital proof of ownership, existing on the blockchain network

- The creation of an NFT, known as minting, involves its publication on the blockchain, facilitating its purchase or sale

- While 2021 witnessed a significant expansion in the NFT market, it experienced a contraction in the following year.

Cons:

- Since the majority of NFTs represent static assets that don’t produce any standalone income, their worth is mainly dictated by subjective elements like the demand from buyers.As a result, the current high prices may not be sustainable, and NFTs could experience a significant drop in value

- The creation and sale of NFTs are not free, and the associated fees can exceed the value attributed to an NFT by other users on a marketplace

- NFTs and the underlying blockchain technology have an environmental footprint, as they consume a substantial amount of energy to create and validate transactions

- Some NFT projects may not provide the rights to the digital asset itself, so it’s important to do your due diligence to determine the location of the digital asset (at a web address, in centralized cloud storage, etc.) and whether you have the ability to move the asset to a different location

BitBuy

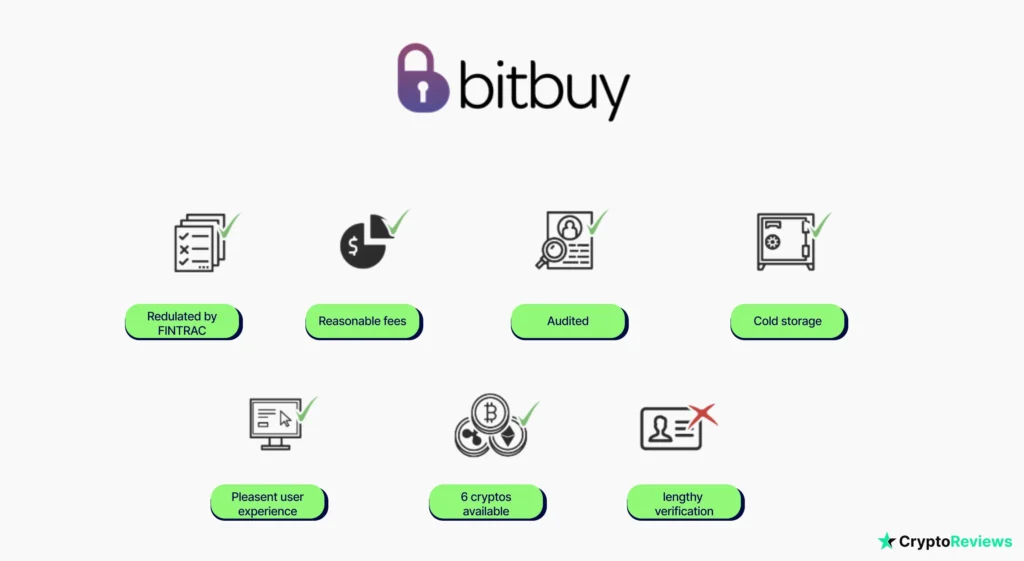

When it comes to buying Bitcoin in Canada, the options are somewhat limited as many international platforms either exclude Canadian residents or provide limited features. However, BitBuy stands out as a top choice for Canadian residents. Founded in 2013, BitBuy offers a user-friendly experience and reasonable fees.

Pros:

- Registered and regulated: BitBuy is a registered money service business regulated by FINTRAC.

- Low fees: Compared to other platforms in Canada, BitBuy offers reasonable funding fees, trading fees, and withdrawal fees.

- Successful audits: BitBuy has undergone multiple successful regulatory and financial audits.

- High security: The platform stores most funds in cold storage, ensuring the safety of your funds.

- User-friendly platform: BitBuy provides a pleasant user experience.

- Nine available cryptocurrencies: While not extensive, BitBuy offers a decent selection of nine cryptocurrencies for trading.

Cons:

- Since the majority of NFTs represent static assets that don’t produce any standalone income, their worth is mainly dictated by subjective elements like the demand from buyers.As a result, the current high prices may not be sustainable, and NFTs could experience a significant drop in value

- The creation and sale of NFTs are not free, and the associated fees can exceed the value attributed to an NFT by other users on a marketplace

- NFTs and the underlying blockchain technology have an environmental footprint, as they consume a substantial amount of energy to create and validate transactions

- Some NFT projects may not provide the rights to the digital asset itself, so it’s important to do your due diligence to determine the location of the digital asset (at a web address, in centralized cloud storage, etc.) and whether you have the ability to move the asset to a different location

Kraken

Kraken has positioned itself as one of the most secure cryptocurrency exchanges globally and is the only crypto company to have obtained the Special Purpose Depository Institution (SPDI) license.

Pros:

- Exceptional trustworthiness: Kraken holds a US banking license, which is notoriously challenging to obtain, making it an extremely reliable platform.

- Multiple trading interfaces: Kraken offers five different types of trading interfaces, catering to varying levels of complexity. Most exchanges only provide one interface.

- Earn and staking features: Utilize Kraken’s “Earn” accounts to stake your digital assets and earn up to 20% annually.

- OTC desk: Kraken serves institutional and high-net-worth individuals through its specialized OTC services.

- Extensive token selection: With 78 tokens and 357 liquid markets, Kraken offers a robust range of cryptocurrencies.

- No minimum deposit: Trade with any desired amount, as there is no minimum deposit requirement.

- Degressive fee structures: The more you trade, the lower your fees become.

Cons:

- Since the majority of NFTs represent static assets that don’t produce any standalone income, their worth is mainly dictated by subjective elements like the demand from buyers.As a result, the current high prices may not be sustainable, and NFTs could experience a significant drop in value

- The creation and sale of NFTs are not free, and the associated fees can exceed the value attributed to an NFT by other users on a marketplace

- NFTs and the underlying blockchain technology have an environmental footprint, as they consume a substantial amount of energy to create and validate transactions

- Some NFT projects may not provide the rights to the digital asset itself, so it’s important to do your due diligence to determine the location of the digital asset (at a web address, in centralized cloud storage, etc.) and whether you have the ability to move the asset to a different location

Huobi

Although Huobi is not accessible to users in the United States, it has established a strong presence and offers a wide range of investment products related to cryptocurrencies. Huobi boasts an extensive selection of tokens and imposes minimal country restrictions.

Pros:

- Exceptional trustworthiness: Kraken holds a US banking license, which is notoriously challenging to obtain, making it an extremely reliable platform.

- Abundance of crypto options: Huobi offers hundreds of cryptocurrencies for trading.

- Crypto-to-crypto and card trades: Users can engage in crypto-to-crypto trades as well as purchase cryptocurrencies using debit and credit cards.

- User-friendly interface: Huobi’s platform is designed with simplicity in mind, making it easy for newcomers to navigate.

- Vast token selection: With over 350 tokens available for trading, Huobi offers a broad range of options. The platform also includes introduction pages for each token.

Cons:

- Since the majority of NFTs represent static assets that don’t produce any standalone income, their worth is mainly dictated by subjective elements like the demand from buyers.As a result, the current high prices may not be sustainable, and NFTs could experience a significant drop in value

- The creation and sale of NFTs are not free, and the associated fees can exceed the value attributed to an NFT by other users on a marketplace

- NFTs and the underlying blockchain technology have an environmental footprint, as they consume a substantial amount of energy to create and validate transactions

- Some NFT projects may not provide the rights to the digital asset itself, so it’s important to do your due diligence to determine the location of the digital asset (at a web address, in centralized cloud storage, etc.) and whether you have the ability to move the asset to a different location

Honorable Mentions:

If you’re seeking additional options to buy Bitcoin, consider the following platforms:

- Binance Jersey (exclusive to UK and EU residents)

- Coinmama (for quick Bitcoin purchases)

- LocalBitcoins (for anonymous Bitcoin transactions)

- CEX.io

- Bittrex

- Gemini

Introduction To The Crypto World

Understanding the crypto world requires knowing the distinctions among Bitcoin, other cryptocurrencies, blockchain, exchanges, and wallets.

Bitcoin, the foremost and most significant cryptocurrency, sets it apart from thousands of others.

Bitcoin’s divisibility surpasses that of the dollar, as $1 can be divided into $1.00, whereas Bitcoin can be divided into 1.00000000, allowing ownership of 0.00000001 BTC.

Blockchain serves as the roadway for Bitcoin, facilitating secure transactions between users.

Exchanges, like eToro and Coinbase, enable the exchange of fiat money for cryptocurrencies.

Wallets, such as Blockchain.com, provide secure access to the blockchain, enabling secure storage and transfer of Bitcoin and other digital assets.

To initiate your Bitcoin journey, answer the crucial questions: where and how to buy Bitcoin. Remember, the best purchasing options depend on your location and expectations.

Selecting the Ideal Platform for Your Requirements

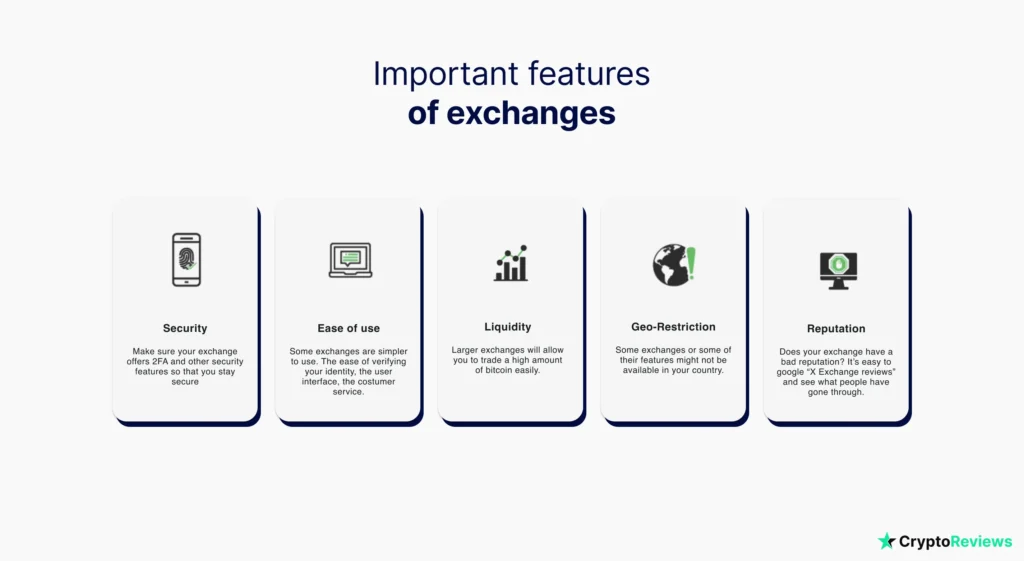

In 2023, there is a multitude of exchanges and avenues to purchase Bitcoin. Are you aware of how to choose the most suitable exchanges for buying bitcoin? Not all exchanges are equal, as each possesses unique characteristics.

Before delving into investing in Bitcoin based on your needs, it is crucial to understand your own preferences and the process of buying bitcoins.

Consider the following factors:

1. Anonymity

Exchanges, particularly the larger ones, are legally obliged to admit only users who comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. These legal obligations are in place to prevent money laundering and the financing of terrorism. Consequently, even if one exchange stands out as an excellent option for purchasing bitcoin, you will still need to provide and verify your identity.

2. Fees

Various exchanges impose different fees. This goes without saying. If you prioritize the most cost-effective or fastest method of acquiring bitcoin, fees will play a significant role in your decision.

3. User-Friendliness

Some exchanges offer a more straightforward user experience. Factors such as ease of identity verification, user interface design, and customer service contribute to your preference for a particular exchange.

4. Payment Methods

Are you aware that you can purchase Bitcoin using a credit or debit card? Additionally, traditional methods such as bank account transfers and cash are available.

5. Regulatory Compliance

Ensuring that your chosen exchange adheres to regulatory standards is a prudent approach. If an exchange requires KYC and AML checks, you can be confident that you are on the right track.

6. Security

Safeguarding against identity theft is of utmost importance. Verify that your chosen exchange offers features like two-factor authentication (2FA) and other security measures to ensure your safety. By considering these factors, you can make a well-informed decision and select the exchange that best aligns with your needs and priorities for purchasing Bitcoin.

7. Limits

Similar to banks, exchanges may impose withdrawal limits based on the level of identity verification. Consider exchanges that offer higher withdrawal limits for a more convenient Bitcoin purchasing experience.

8. Liquidity

Trading volume plays a significant role in liquidity. Larger exchanges generally offer greater liquidity, allowing for the buying and selling of Bitcoin at more favorable prices.

9. Speed

The speed at which an exchange processes orders is important to avoid delays and capitalize on market fluctuations.

10. Insurance

A crucial factor is whether the exchange provides insurance coverage. This ensures protection in the event of exchange shutdowns, hacks, or misappropriation of funds.

11. Reputation

Research the reputation of an exchange by reviewing user feedback and experiences. While ratings should be approached with caution, examining specific negative comments can reveal recurring issues and provide a more accurate assessment.

12. Customer service

Although often overlooked, reliable customer service becomes vital when problems arise. Consider factors such as response times, support availability, and language options.

13. Geo-restriction

Some exchanges may have limitations in certain countries. Check the provided links for each recommended exchange to determine whether it is accessible in your area.

Note: Taking these factors into account will enable you to make an informed decision and select the most suitable exchange to buy Bitcoin based on your specific needs and preferences.

Payment Methods Compared

Objective: To provide a brief comparison of different payment methods for investing in Bitcoin, aiding in the selection of the most suitable option based on individual needs.

Credit/Debit Card:

- Offers a seamless and prompt method for Bitcoin investment.

- Provides convenience, as no physical movement is required except for card retrieval.

- However, it’s important to note that purchase limits are relatively low to mitigate fraud risks, and fees tend to be higher due to potential chargebacks.

Bank Transfers:

- Allows for larger purchase amounts, although transaction processing may be slower.

- Offers the advantage of significantly lower fees, especially when using exchanges.

- Generally considered one of the preferred methods for profitable cryptocurrency investing.

Cash:

- Enables anonymous Bitcoin purchases, as it is not tied to personal identities.

- Cash transactions through Bitcoin ATMs or platforms like LocalBitcoins can be relatively swift and straightforward.

- Important to consider that neither option is insured, and fees can vary considerably, making it less ideal for Bitcoin acquisition.

PayPal:

- Regarded as the easiest method for purchasing Bitcoin, surpassing even credit card convenience.

- However, the process typically involves exchanging PayPal funds for cash or transferring funds to a bank account for subsequent purchase, making it less favorable.

- Disadvantages of using PayPal include higher fees, lack of anonymity, and potential delays in processing.

Conclusion: When considering payment methods for Bitcoin investment, it is crucial to assess individual requirements and preferences. While credit/debit cards offer ease and speed, bank transfers provide higher purchase limits and lower fees, making them favorable for profitability.

Cash transactions allow for anonymity but lack insurance coverage and exhibit fee variations. Although PayPal offers convenience, it falls short due to higher fees, absence of anonymity, and potential delays. By evaluating these factors, one can select the most suitable payment method for acquiring Bitcoin.

The Most Economical Platform for Purchasing Bitcoin

eToro stands out as the most cost-effective platform for buying Bitcoin and other cryptocurrencies. Users encounter a 1% fee added to the spread when engaging in crypto asset transactions on eToro. This fee is incorporated into the displayed price when opening or closing positions.

For residents in the United States, Coinbase also offers competitive pricing, while BitBuy provides a similar advantage for Canadian residents.

Recommendation: If your goal is to acquire Bitcoin with the lowest possible fees, utilizing your bank account to deposit funds is generally the preferred approach.

The Optimal Method for Secure Bitcoin Purchases

To the best of my knowledge, all the options mentioned here provide a secure means of purchasing Bitcoin.

Each option offers security measures in different ways: eToro, for instance, boasts a longstanding operational history of over 14 years and holds regulatory compliance in multiple countries. Coinbase provides numerous security features alongside insurance coverage that safeguards against certain types of losses, and so forth.

Recommendation: To uphold the safety of both your identification and account, I highly recommend enabling two-factor authentication (2FA) for all the cryptocurrency exchanges you utilize. Taking this precautionary step is paramount for maintaining security.

The Simplified Method for Purchasing Bitcoin

Among the options listed, eToro emerges as the easiest way to buy Bitcoin.

Their registration process is notably seamless compared to other alternatives, allowing for fee-free deposits and permitting trading even before verification documents are approved. This positions eToro as one of the top exchanges for Bitcoin purchases.

The Expedited Approach to Buying Bitcoin

Inquiring about the quickest method to purchase Bitcoin? Look no further than the eToro app, which facilitates swift transactions through debit cards or credit cards with debit features.

Another option is to utilize Bitcoin ATMs (BTMs), which are increasingly prevalent in various countries worldwide. Even mid-sized cities like Portland, Oregon, host multiple BTMs. These machines enable users to deposit cash and withdraw Bitcoin effortlessly.

Locating Nearby Bitcoin Purchase Opportunities

BTMs are sprouting up in cities across the globe, and the easiest way to discover them is through Coin ATM Radar.

However, it’s important to note that some BTMs may require ID verification, as regulations vary based on state (in the US) or country and even city (outside the US) laws. Prior to purchasing, it is advisable to research local BTM laws or carefully review the guidelines provided at the BTM location.

Optimal Methods for Anonymous Bitcoin Purchases

The era of purchasing Bitcoin anonymously is gradually diminishing. In the past, platforms like Shapeshift or Changelly offered anonymous BTC transactions. However, governments have since increased enforcement of Know Your Customer (KYC) and Anti-Money Laundering (AML) laws on most Bitcoin purchasing platforms.

Presently, the best way to buy Bitcoin anonymously is by directly purchasing it from an individual. This can be achieved by attending a Bitcoin meetup in your area and seeking potential trading partners or by exploring reputable sellers on platforms such as LocalBitcoins.

Top Choices for Buying Bitcoin with PayPal

If you prefer to use PayPal as a payment method, one of the best options is to utilize an established intermediary like eToro. They accept PayPal deposits without fees, making it an excellent and possibly the optimal way to buy Bitcoin.

However, I advise caution when purchasing BTC with PayPal on platforms that don’t offer it as a direct payment method. In such cases, you would need to go through intermediaries, and the fees can increase up to 10% per trade.

Preferred Platform for Buying Bitcoin with Credit/Debit Card

When it comes to buying Bitcoin with a credit or debit card, the key factors to consider are security, reasonable fees, and convenience. For most individuals, eToro stands out as the best option for purchasing Bitcoin with a debit card. It offers a seamless, free, and fast experience.

Coinbase is also an excellent choice, particularly considering its availability across various regions. However, it’s worth noting that BitBuy does not support deposits with credit or debit cards.

If you prioritize anonymity, you can explore LocalBitcoins for purchasing cryptocurrencies with credit or debit cards. However, it’s important to be aware that the rates will be significantly higher.

Recommended Platforms for Buying Bitcoin with a Bank Account

Once again, eToro and Coinbase (for US, UK, and EU residents) are the preferred platforms for purchasing Bitcoin using a bank account. While this method requires identity verification, these exchanges have streamlined the process to ensure ease of use.

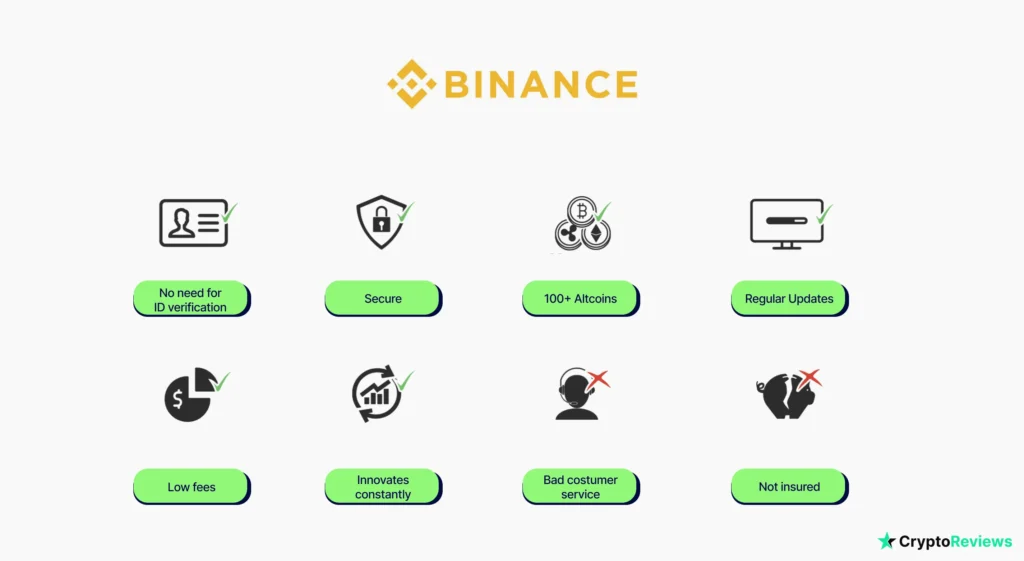

Purchasing Other Cryptocurrencies (Altcoins)

Most fiat-to-crypto platforms have a limited selection of cryptocurrencies. If you wish to diversify your portfolio and acquire more altcoins, it is advisable to use platforms that allow you to trade Bitcoin for other cryptocurrencies.

Among such platforms, Binance (the international version) is the leading exchange and one of the largest worldwide. It offers a wide range of altcoins and maintains regular updates to ensure a high-quality selection. Basic accounts on Binance do not require ID verification, providing a level of anonymity. Additionally, the exchange prioritizes security, offers low fees (0.1% and lower), and continues to innovate, such as introducing its own token called Binance Coin (BNB) to further reduce fees.

However, it’s important to note that Binance may not provide the best customer service experience, and the platform is not insured.

FAQS

Should I consider buying bitcoins?

Absolutely! Investing in bitcoins doesn’t require a large sum of money. Even a small amount, like $5, can get you started and help you understand this new technology. You’ll learn how to buy, sell, and transfer bitcoins, and then you can decide whether to invest more or not.

How can I legally buy bitcoin?

If purchasing bitcoin is legal in your country, you have several options available. Directly from individuals, use cryptocurrency exchanges, or even earn it through work or Bitcoin faucets.

Which platforms are the safest for buying bitcoin?

The safest platforms for buying bitcoin are the ones that follow Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, where is require to verify your identity, which demonstrates their commitment to legal compliance and responsible practices, to minimize the risk of dealing with fraudulent or unreliable companies.

What is the most cost-effective way to buy bitcoin?

The most cost-effective method to purchase bitcoin is by buying it directly from an individual at the current exchange rate. This allows you to avoid transaction fees. If this option is not available, look for reputable large exchanges that offer low transaction fees.