The crypto industry is home to both consistent winners and losers. One crucial factor that sets the winners apart is their use of the best crypto tools available in the market.

While networking with other investors is important, there is an element of luck involved in meeting the right people and discovering top trading tools. However, you can take action now by experimenting with different tools that suit your needs, and it can significantly improve your operations.

This distinction can be the deciding factor between uncovering the next hidden gem that doubles your portfolio and blindly following the herd by investing in overpriced cryptocurrencies.

In this guide, I will provide you with a checklist of the best crypto tools to use in 2023, which will revolutionize the way you engage with the crypto sphere.

Contents

- 1 1. Best Exchanges

- 2 2. Best Descentralized Exchange

- 3 3. Trading Platforms

- 4 4. Market Data

- 5 5. Charting Tools

- 6 6. Never Miss a Hard Fork, Airdrop, Swap, or Block Halving

- 7 7. Network Statistics

- 8 8. News Aggregators

- 9 9. Research Reports

- 10 10. Trading Bots

- 11 11. Crypto Tax

- 12 12. Portfolio Trackers

- 13 13. Portfolio Rebalancing

- 14 14. Best Wallets

- 15 15. Best Mining Tools

- 16 16. Mining Calculators

- 17 17. Block Explorers

1. Best Exchanges

Why is Choosing the Best Exchanges Important? The first step to achieving substantial profits is selecting reliable exchanges to trade on. Exchanges serve as your gateway to the crypto world. Three key factors differentiate between a useful exchange and an ineffective one: liquidity, security, and fees. Keep these factors in mind when choosing the best crypto exchange platform for your needs.

- Liquidity determines the ease of buying or selling an asset. Ample liquidity ensures that there will always be a buyer or seller available for your transactions.

- Security is crucial because when your funds are on an exchange, you trust them to safeguard your money. It is essential to ensure that the exchange has robust security measures in place to protect against potential attacks. Recent incidents like the Cryptopia hack serve as a reminder of the risks involved.

- Fees play a significant role, especially for experienced traders who factor them into their profits. Therefore, I will recommend exchanges that offer not only liquidity and security but also competitive fees.

And the Best Exchanges Are:

Binance:

As of now, Binance boasts the highest trading volume in the market. This indicates significant liquidity and ensures that transactions can be executed swiftly. With a clean track record, a reliable team, and a large user base, I confidently recommend Binance as one of the must-use exchanges.

Coinbase Pro:

Although Coinbase Pro offers fewer trading pairs compared to Binance, it is highly trusted, particularly among larger investors. Being based in the US and FDIC insured, Coinbase Pro provides an added layer of security. The FDIC insurance means that US users are insured for up to $250,000 in their USD wallet.

BitMEX:

For those inclined to take risks, BitMEX offers an exciting option. With leverage of up to 100x, it provides high-risk, high-reward opportunities. Based in Hong Kong and never compromised by hackers, BitMEX serves as a viable alternative to spot trading exchanges like Binance and Coinbase Pro.

2. Best Descentralized Exchange

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) performs the same functions as a centralized exchange, like the ones mentioned earlier, but with a decentralized technical infrastructure.

Why Use DEXs in Addition to or Instead of Centralized Exchanges?

Decentralized exchanges offer the advantage of users not needing to deposit funds to the exchange, allowing them to keep their funds secure in their own wallets. This enhances security for users. However, DEXs can be more challenging to use and typically have lower liquidity.

What Are the Best DEXs?

IDEX

IDEX is one of the longest-running decentralized exchanges still in operation. It is web-based and features a user-friendly interface. With ample liquidity, average traders can easily execute their orders without issues.

3. Trading Platforms

What is a Trading Platform and How Can It Benefit Me?

Trading platforms are valuable crypto trading tools that streamline your trading activities, taking them to the next level. Instead of managing multiple windows across various exchanges, you can trade on multiple exchanges from a single platform. This enables you to seize market opportunities quickly and closely monitor the market.

What Are the Best Trading Platforms?

Coinigy

Coinigy is arguably the most widely used trading platform in the market. Established in 2014, it has continued to grow in popularity. Coinigy supports trading on 45+ exchanges, offers comprehensive trading charts, and provides quality customer support. Its extensive exchange support gives Coinigy users a competitive advantage.

Coinigy also offers historical data for purchase, allowing developers to experiment with their own trading strategies. It is considered one of the industry’s top crypto trading tools.

Tradedash

Tradedash supports trading on both Bittrex and Binance, two reliable and prominent exchanges in the market. Liquidity is not an issue due to these exchange integrations. Unlike Coinigy, Tradedash is a desktop application, providing enhanced privacy and security as users’ private keys are encrypted and stored on their own machines.

4. Market Data

Why is Market Data Important?

Accurate and timely market data is crucial for investors and traders to make informed decisions. It provides essential information about price movements, circulating ans total supply, and more. Having access to this information is vital for profitability and success.

What are the Best Sources for Market Data?

Coinmarketcap

Coinmarketcap is a widely used platform for checking prices, trading volume, and coin supply. It offers a robust API for integrating data into your own user interface. This is a popular choice among traders and investors due to its comprehensive coverage and user-friendly interface.

OnchainFX

OnchainFX not only provides market data similar to Coinmarketcap but also offers unique statistics. It categorizes coins as scams, identifies top gainers and losers, and even provides predictions for future market caps. Additionally, users can customize their own dashboard. This platform is gaining recognition as a trusted source.

CryptoCompare

CryptoCompare has been a reliable source of market data in the industry for a long time. It offers accurate data, portfolio tracking tools, and informative articles on new developments and different cryptocurrencies. With a large and dedicated following, CryptoCompare is worth considering for accessing market data and staying informed.

These platforms provide valuable insights and information to help you make informed decisions in the dynamic cryptocurrency market.

5. Charting Tools

How can a Charting Tool Benefit Me?

A charting tool is an essential resource that enables you to visualize trading indicators and draw trend lines, aiding in the analysis of market trends.

By practicing with these tools, you can enhance your skills in technical analysis (TA), a strategy commonly employed by traders to anticipate market movements.

Proficiency in TA can lead to significant gains, making the use of crypto analytics tools indispensable.

Which Charting Tools are Recommended?

TradingView

TradingView is a prominent company offering live trading charts for cryptocurrencies and stocks. As one of the largest providers of charting services, TradingView offers an extensive range of technical indicators to suit all your needs.

They provide both free and premium functionalities, making it a favored choice among top traders as their go-to tool for charting cryptocurrencies.

Cryptowat.ch

Cryptowat.ch, owned by the renowned exchange Kraken, is a completely free charting tool that allows you to analyze multiple coins and view more than 10 charts simultaneously. I

t’s a highly recommended platform that offers comprehensive cryptocurrency charts without any cost. Exploring Cryptowat.ch is definitely worthwhile, as you have nothing to lose but much to gain with its valuable features!

6. Never Miss a Hard Fork, Airdrop, Swap, or Block Halving

Instead of relying solely on news articles, it’s beneficial to utilize trusted calendar services to stay informed about upcoming events. These services provide a quick glance at upcoming events in the cryptocurrency space.

Why is this important?

Events such as coin halvings or hard forks can have a significant impact on coin prices, and they may even present opportunities to receive free coins. By staying informed and taking advantage of these events, you can potentially generate substantial profits.

Some Recommended Calendar Tools:

CoinMarketCal

CoinMarketCal is a preferred crypto trading tool that helps you capitalize on the strategy of buying the rumor and selling the news, which many traders follow.

It’s a comprehensive calendar that showcases upcoming events across different coins. You can even search for specific coins, enabling you to stay ahead of market movements.

Coindar

Similar to CoinMarketCal, Coindar offers a sleek interface and allows you to quickly view major upcoming events at a glance. It’s a useful tool for keeping track of significant developments in the crypto world.

7. Network Statistics

Don’t rely solely on negative news articles about Bitcoin transactions or high fees. Explore the data yourself through various crypto tools. By monitoring Bitcoin’s network activity and a coin’s development team, you can gain valuable insights.

Why is this important?

Observing transactional activity on Bitcoin’s network can serve as an indicator for future price movements.

Understanding the level of activity on Bitcoin’s network or any other cryptocurrency’s network, as well as assessing a team’s development efforts, can provide you with an edge over many traders.

Recommended Coin Insights Tools:

BitcoinVisuals

BitcoinVisuals is an underrated crypto tool that focuses on the king of crypto, Bitcoin. It offers valuable information on metrics such as median fee costs per transaction and hashrate.

By assessing the technical aspects of the network, such as fee trends and miner participation, you can make informed decisions.

Additionally, BitcoinVisuals allows you to fact-check news claims and draw your own conclusions.

CryptoMiso

CryptoMiso is applicable to all coins, not just Bitcoin. It helps you evaluate the activity of a project’s development team by checking their GitHub activity. Active development is crucial when analyzing a coin, as a lack of activity could indicate a dead project.

CryptoMiso allows you to ensure that open-source projects are actively maintained, providing you with important insights for your investment decisions.

8. News Aggregators

How can News Aggregators Help in Making Profits?

With the abundance of news sites publishing numerous articles each day and conflicting opinions from Twitter influencers, having a reliable source that aggregates all this information in one place can be immensely beneficial.

News aggregators provide a consolidated view of the market, enabling quick access to news and a comprehensive understanding of the current landscape. These crypto analytics tools simplify the process of staying updated and help in making informed trading decisions.

Prominent News Aggregators Preferred by Professionals:

CryptoPanic

CryptoPanic is an exceptional, free news aggregator that offers a comprehensive platform for monitoring news. It even allows you to customize your dashboard and set up price alerts.

This tool saves you the trouble of juggling multiple sources and ensures you won’t miss any significant news. It’s an excellent choice for analyzing crypto news.

Cryptopys

Cryptopys is an excellent choice due to its smooth interface, sleek design, and user-friendly experience. The larger font size enhances readability, allowing you to stay updated with real-time news in the crypto industry.

The platform is divided into two sections: news and coins, providing you with the ability to track real-time price changes, 24-hour volume, market capitalization, circulating supply, and more.

9. Research Reports

How can Research Reports Benefit Traders?

Research reports are comprehensive and highly valuable documents that delve into fundamental analysis, technical analysis, and offer opinions on past, present, and future market trends. These reports provide deep insights, enabling traders to develop a comprehensive understanding of market dynamics and make well-informed investment decisions.

Recommended Research Report:

Crypto Research

Report Crypto Research Report publishes quarterly reports that extensively cover the cryptocurrency market. These reports include interviews, statistical analysis, fundamental analysis, and future market projections. You can access a free example report by clicking here, and signing up is also free. Embracing these research reports provides traders with a formal and well-rounded perspective on the market, contributing significantly to their trading success.

10. Trading Bots

Trading bots are software programs that allow you to automate your trading by setting specific parameters for executing trades. With the right strategy and a reliable bot, you can generate profits even while you sleep, essentially using them as crypto prediction software.

While it’s important to be cautious as not all bots are trustworthy, I can recommend a few highly recommended options.

The Top Bots in the Market are:

HaasOnline

With a 5-year presence in the industry, HaasOnline has established itself as a reputable trading bot provider. It offers a wide range of technical indicators, a sleek user interface, and reliable performance.

Additionally, it allows you to explore arbitrage opportunities if you wish. Utilizing this crypto tool and experimenting with automated trading solutions can lead to significant profits.

Grid Trading Bot by Pionex

Pionex’s Grid Trading Bot is an exceptional trading program that enables users to execute trades based on predetermined price ranges in the crypto market. This reduces the likelihood of human error in trading decisions.

Setting up a Pionex Grid Trading Bot is a straightforward process, and the platform supports various trading pairs and cryptocurrencies, operating 24/7. The website provides comprehensive explanations of the installation process, and you can enjoy trading from both desktop and mobile devices.

Moreover, Pionex offers a range of bots, including rebalancing bots, spot-futures arbitrage bots, leveraged grid bots, margin grid bots, and more, leveraging powerful quantitative algorithms and providing recommendations on Grid Trading Bot settings.

11. Crypto Tax

Tools Tax season can be particularly challenging for cryptocurrency traders. Crypto tax tools can assist in organizing your trades and automating the process of calculating your tax liabilities.

The Best Tax Tools are:

Cointracking.info

Cointracking.info allows you to manually import your historical transaction data or use API integration. It calculates your performance and generates tax reports that you can directly provide to your accountant. This tool is unparalleled in the industry and not only serves as a tax tool but also as an excellent portfolio tracker, making your life much easier.

Token Tax

TokenTax is a specialized tax-focused software that calculates your crypto taxes along with your overall income. It serves as an alternative to platforms like TurboTax and saves you hours of time by streamlining the tax filing process.

12. Portfolio Trackers

How will Portfolio Trackers help me in my trading journey?

One of my favorite tools that can greatly assist you is a portfolio tracker. Portfolio trackers are widely used in the crypto community and provide a convenient way to stay updated on the performance of your investments.

With just a quick glance, you can monitor the total value of your portfolio, track the 24-hour changes, and analyze the performance of individual coins within your portfolio. By identifying any underperforming assets, you can make informed decisions to optimize your portfolio.

My Recommended Portfolio Trackers are:

CoinStats

CoinStats is a mobile-only app that allows you to effortlessly import your trades via API integration. This automated process saves you valuable time and provides seamless tracking of your portfolio.

Cointracking

As mentioned earlier, Cointracking is the most popular web-based portfolio tracking service. It offers an affordable solution and supports integration with a wide range of exchanges.

By automatically calculating your historical data upon importing your trades, Cointracking simplifies the tracking process.

Many traders consider it an essential tool in their cryptocurrency arsenal.

Blox

For those seeking a professional web-based solution, Blox is an excellent choice. It offers both free and premium versions.

With the free version, you can enjoy automatic tracking and the creation of multiple portfolios for up to $50,000 in assets under management (AUM) or 100 transactions.

If your portfolio surpasses these limits, the premium version is required. Overall, Blox provides a great value proposition.

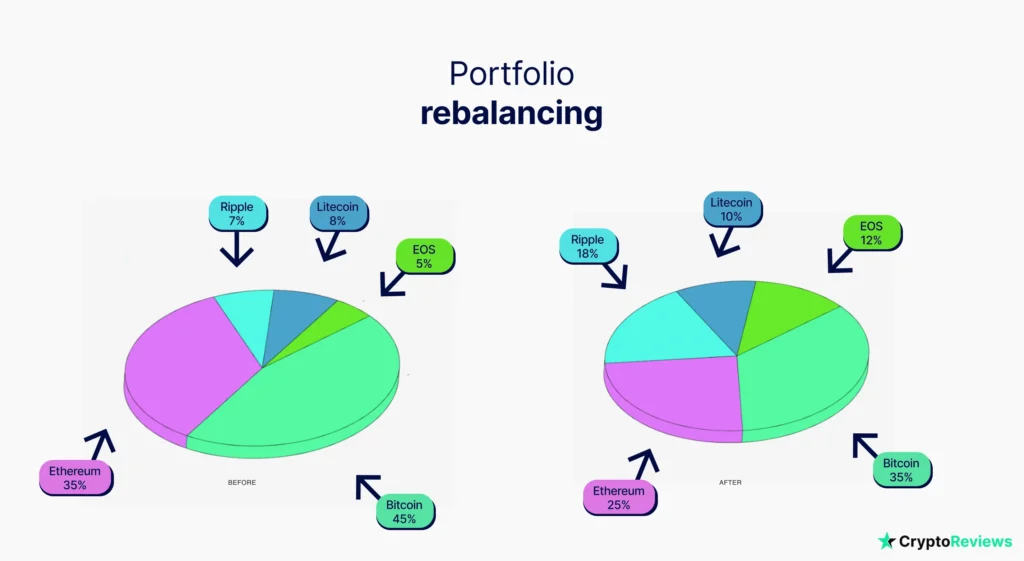

13. Portfolio Rebalancing

What is Portfolio Rebalancing?

Sophisticated traders often leverage portfolio rebalancing to manage risk and optimize profitability. This strategy involves automatically buying and selling assets within your portfolio based on predetermined weights. For instance, if you want your Ether holding to consistently represent 10% of your portfolio, but its value increases and exceeds the target, the rebalancing tool will automatically sell some Ether to bring it back to the desired proportion. Even hedge fund managers utilize rebalancing tools to enhance their portfolios. Traders of all experience levels can benefit from these rebalancer crypto tools.

How will it help me maximize profits?

Portfolio rebalancing acts as a safeguard against overexposure to surging assets, ensuring continued profit generation. In the Ether example, most people would hesitate to sell their Ether if it reached 30% of their portfolio from an initial 10%. However, due to the volatility of cryptocurrencies, such fluctuations can occur frequently. By rebalancing, you can consistently secure profits while maintaining a healthy Ether holding that aligns with your desired portfolio composition.

What are the Best Rebalancing Tools?

Shrimpy

Shrimpy is an excellent free rebalancing tool that also includes a backtesting feature. In addition to rebalancing, you can test different strategies using historical data from major exchanges supported by Shrimpy. Despite the bear market, Shrimpy has gained significant traction, executing over $250,000,000 worth of trades on behalf of its users.

3Commas

Unlike Shrimpy, 3Commas is not free but offers additional features. You can schedule automatic rebalancing, even as frequently as every 12 hours. Furthermore, 3Commas provides general portfolio management tools and allows manual trading from their platform.

14. Best Wallets

Why Choosing the Best Wallets is Crucial

In the world of cryptocurrencies, your wallet serves as your bank, and selecting a reliable wallet is paramount. A secure wallet safeguards your funds from potential hackers and ensures the integrity of your transactions. Losing your private keys or making errors due to poor wallet user interfaces or security measures can lead to devastating financial losses. Therefore, it’s essential to choose the best wallets available in the market.

Here are the Top Wallets to Consider:

Mycelium

Mycelium is my personal favorite Bitcoin wallet. It is a mobile-only wallet that offers a user-friendly experience. During the setup process, make sure to note down your seed phrase, and you’re ready to use it. I highly recommend giving Mycelium a try.

Metamask

Metamask is a widely popular Ethereum wallet. It operates as a web-based Chrome or Brave browser extension, allowing seamless transactions of Ether and ERC-20 tokens to decentralized applications (dApps) on the web.

Most dApps are compatible with Metamask, making it a convenient choice for Ethereum users.

MEW (MyEtherWallet)

MEW, also referred to as MyEtherWallet, is a trusted and user-friendly wallet designed specifically for Ethereum and ERC-20 tokens. It offers seamless integration with hardware wallets like Ledger and Trezor, providing an extra layer of security for your digital assets.

Additionally, MEW has partnered with prominent platforms such as Changelly, Simplex, Kyber Network, and Bity to enable convenient coin swapping. With continuous product improvements and positive feedback from users, MEW remains a reliable choice.

Ledger Nano S

When it comes to hardware wallets, my top recommendation is the Ledger Nano S. Unlike software wallets like Exodus and Mycelium, the Ledger Nano S is a physical device that operates offline, ensuring heightened protection against potential hacking attempts.

With its extensive support for over 1,000 coins and tokens, exceptional customer support, and a large user base, the Ledger Nano S is an ideal investment, particularly for individuals with substantial cryptocurrency holdings.

Exodus

In the early days of cryptocurrencies, managing different types of coins required downloading separate wallets for each one.

However, with the advent of Exodus, that’s no longer a necessity.

This versatile wallet supports over 100 different coins, provides the option to buy cryptocurrencies, and comes with straightforward backup features.

In summary, Exodus offers a user-friendly, popular, and hassle-free experience for crypto management. Using it can save you significant time and stress.

15. Best Mining Tools

Understanding Mining

Mining can be a complex process, but in simple terms, it involves participating in a network by validating transactions and securing the network. Typically, you download specific mining software for a particular coin and start mining. In return for your efforts, you receive coins as rewards.

Is Mining Profitable?

The profitability of mining depends on various factors. It relies on the coin being mined and the strength of your computer or mining rig. If you mine a coin early on and accumulate a substantial amount, and if its value increases over time, mining can be highly lucrative.

Getting Started with Mining

NiceHash

I recommend starting with NiceHash. It is a cloud mining company, which means you don’t need to worry about having your own mining hardware. Instead, you can experiment with mining on different networks using the NiceHash platform. While many cloud mining companies are unreliable, NiceHash is a trustworthy option to explore. Have fun and see what you can discover!

16. Mining Calculators

Understanding Mining Calculators

Mining profitability depends on various factors, including the coin being mined, hardware costs, the power of your equipment, and electricity expenses. Calculating all these variables can be a daunting task. Fortunately, mining calculators exist to help you estimate potential profits and make informed decisions about which networks are most profitable to mine.

Whattomine

Whattomine is an excellent website where you can enter different mining parameters, select a specific coin, and view predicted income across various time frames. It’s an amazing tool that allows you to speculate from a mining perspective. Here’s an example for Bitcoin.

CryptoCompare

As mentioned earlier, CryptoCompare offers a mining calculator as well. While it may not provide as many coin options or parameter inputs as Whattomine, it is still a reliable tool for estimating mining profits. CryptoCompare’s calculator offers a simpler version of the functionality found in Whattomine.

17. Block Explorers

Understanding Block Explorers and Their Benefits

A block explorer is a user-friendly interface that enables you to interact with blockchains and access transactional data on a particular network.

By entering your Bitcoin wallet address or transaction ID, you can track the progress of your Bitcoin transactions, including the number of confirmations and delivery status.

Block explorers offer various other information, such as outstanding and past transactions, current block height, transaction sizes, and details about the largest wallets and number of coin holders.

Top Blockchain Explorers

Blockchain.com

Blockchain.com provides a comprehensive block explorer that supports BTC, ETH, and BCH blockchains. When engaging in transactions, using Blockchain.com’s explorer will give you peace of mind by verifying that the transaction is sent and pending on the network. It’s a valuable tool that helps reduce stress.

Etherscan

Etherscan is the go-to block explorer for Ethereum and ERC-20 tokens. It allows you to monitor your Ethereum transactions and provides additional data such as network hashrate, current block height, block data, and market cap. Whether you’re sending Ether transactions or checking the network status, Etherscan is an excellent choice.

Discovering Block Explorers for Any Coin

Every coin has its own dedicated block explorer. To find the block explorer for a specific coin, visit Coinmarketcap.com, search for the coin, and click on “Explorer” on the left side.

If a coin is not listed on Coinmarketcap, you can often find its block explorer directly on the coin’s official website or by searching “Coin name + block explorer” on a search engine.

However, be cautious of deceptive websites and ensure you are accessing the legitimate block explorer for the desired coin.